Not too many years ago trade printing could easily have been viewed as the industry’s poor relation – the image was more likely to involve second- or third-hand presses, or perhaps no press at all but renting time on someone else’s equipment out-of-hours.

Nowadays, successful trade printers are likely to be found running factories bristling with the latest high-tech printing equipment and systems, in a market where efficiency and turnaround times have become key, alongside a pricing environment that remains hugely competitive – as a glance at any of the promotional deals on commodity products such as business cards shows.

And trade printers are seeing opportunities in what is a highly dynamic market.

In the face of fierce competition from both domestic and continental competitors, Peter Bradley, managing director at Quinn’s in Belfast, is in the process of expanding his firm’s offering with a new production facility in England that is set to go live later in the year.

“We are trying to compete on quality and speed rather than just price,” says Bradley.

While a final decision is yet to be made regarding equipment the new factory in Runcorn is likely to involve a press with the latest low-energy UV drying technology.

“It’s all about speed of turnaround and instant finishing, and that type of press would allow us to offer a same day service on uncoated stock,” Bradley explains.

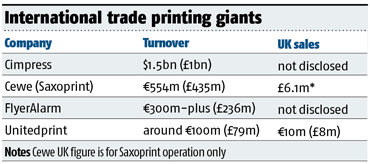

That he sees opportunity for expansion, even in such a hyper-competitive market, is not surprising. The trade printing space is home to some of the industry’s most profitable and fastest-growing businesses. Dundee-based Tradeprint, with its “low-touch production, high-touch care” ethos, was making operating margins of almost 23% when it was crowned PrintWeek Company of the Year in 2014. A year later it was snapped up for a sum not unadjacent to £20m by global web-to-print giant Cimpress, the $1.5bn (£1bn) turnover owner of Vistaprint.

Growing market

The Cimpress growth trajectory has seen it change strategy from focusing on a small number of huge production hubs, to buying up key players in its main target markets. As well as Tradeprint here in the UK, it has acquired Italy’s Pixartprinting, France’s Exagroup (Exaprint), Austria’s Druck.at and Germany’s WirMachenDruck.

Its strategy involves “building a software-enabled operational platform that aggregates and optimises the supply chain and production of mass-customised products”.

Ah, software. For trade printers operating in what might be described as the commodity products space, software is all. A bespoke MIS, for example, enables Tradeprint’s low-touch operation.

And Bradley at Quinn’s describes a “software battle” involving “who can proof jobs fastest” and, indeed, find customers online.

Ganging multiple jobs up, on litho presses from B2 to VLF size, has also become something of an art form. “Ganging work together is one of the only ways to be profitable with print these days,” notes Grafenia chief executive Peter Gunning. “But you need the volume to make it work, and once you’ve got that you need the systems.”

The growth opportunity in trade printing is obvious, not least because of the number of overseas web-to-print giants busily targeting the market with ‘.uk’ web storefronts feeding their giant production sites in other countries.

While Cimpress does not split out its results by country it says UK sales “continue to grow”, and that of course includes more than £10m of Tradeprint business. Saxoprint, which is owned by Cewe, already does more than £6m of business in the UK, while Unitedprint is targeting €15m (£11.8m) in UK sales this year.

Home-grown exponents may not have the same clout (a topic for another day is why there is no UK equivalent to the web-to-print behemoths above) but nevertheless are also experiencing impressive growth rates. Precision Printing managing director Gary Peeling has this to say about the firm’s trade print wing Where the Trade Buys, which it acquired at the end of 2014. “We are experiencing double-digit growth for Where the Trade Buys since relaunch in February and expect a turnover this year of £3.8m. The online market is maturing, competition is strong as is the opportunity as demand is expanding rapidly.”

Perhaps most impressive of all, when it comes to growth is fast-expanding, Bluetree Design & Print, which owns the Instantprint and Route One brands. Sales at the Rotherham business jumped by almost 60% last year to £14.4m, and it featured in the Sunday Times’ Fast Track 100 ranking. Managing director Adam Carnell says sales revenues for the financial year that has just completed are up again, to almost £20m.

“We have tailored the whole experience around trade customers,” he says. “One of our biggest areas is other printers looking to outsource due to capacity constraints, or to produce standard products like business cards without them having the costs of setting a machine up for a small job.”

The Route One offering was launched just three years ago and Carnell describes growth as “phenomenal”. He says success has come from piecing together “three or four very critical parts” of the overall operation. “You need the right production kit, a very strong front-end for clients, and the right systems.”

By way of evidence, the firm employs 19 in-house developers working on its bespoke system. “We see that as our investment in the future,” Carnell adds.

He explains that it typically takes four months of testing and preparation before a new product goes live on the firm’s site, with (apart from the aforementioned business cards) roller banners and presentation folders currently ranking among the top products. “It’s critical to get it right before launch,” he says.

Quality and reliability

And, in a world where straightforward products have become commoditised and incredibly price-driven, trade printers are finding ways to differentiate through quality, service and alternative offerings.

Grafenia, for example, recently added a new ink on fabric range for soft signage and similar products.

“The thing I like about ink-on-fabric is it’s a really difficult thing to do and nothing like printing on paper,” says Gunning, who has high hopes for the new range, which has involved investing in D.gen digital printing equipment and 400 demonstration kits to support its resellers around the country. “We are moving away from £8 business cards to a higher-value item that clients really want.”

That said, litho printing is still core for the company, and Gunning is currently involved in a project to test the quality of his firm’s printed products against those of competitors by carrying out a ‘blind tasting’ with resellers and partners.

“Online, it all looks the same and like it will be great, but the reality is it certainly is not,” he says. “If all you’re doing is buying on price and not caring about quality, or whether the board is yellow, then fine. But our customers do care.”

He says the firm has carved something of a niche producing “urgent, awkward” jobs involving techniques such as foiling. “We are seeing a trend towards fancier things and haptic effects as part of the resurgence of the use of print,” he notes.

And he’s not alone. “It is becoming less about printers selling commodities (they like to produce) cheaply and more about inspirational products that drive revenue growth for our clients while making their procurement really simple,” says Precision’s Peeling. “If a client wants to make money on a £30 digital print order it can’t take more than a minute or two to quote, order and pay for.”

But most important of all, says Gunning, is reliability. And this is an area where UK printers can potentially score against that fierce continental competition.

“If it’s for yourself and it’s a day late, then maybe you don’t care. But if it’s for a client and it’s deadline-specific, then you’re only as good as the next person in the chain,” he asserts.

“We have always had an internal policy of 99.9% on-time delivery. It just has to get there for the deadline. If that sometimes means a dedicated vehicle to meet a client’s deadline, then so be it.”

Elsewhere, Solopress in Southend-on-Sea has been offering a 24-hour turnaround service for a number of years now, but despite this has still found customers arriving at all times of the day and night to pick up their urgent jobs.

Bradley at Quinn’s has also found that customers have an appetite for fast turnaround premium services, and has instigated a ‘click and collect’ option whereby clients can order earlier in the day and collect their jobs the same evening.

However, when jobs are to be delivered to the client, a reliable delivery service is a vital element of any transaction. Carnell at Route One says the company has forged a long-term partnership with delivery group DPD for this reason. “Next-day delivery is a key offering, and we offer one-hour delivery time slot windows as standard,” he notes.

There’s an additional aspect to customer service issues these days: get a job wrong or miss a delivery date and likely enough it won’t just be a matter for the printer and customer to resolve in private. Online reviews on sites such as Trustpilot, on Facebook pages and via Twitter posts, mean that if a job fails to arrive or is not of the expected quality, then customers are likely to let rip in public for all to see.

Specialists

While the online trade printing space is understandably seen as the hot and happening area, trade printers in other specialist areas are also refining their offerings. The UK’s biggest trade printer, Integrity Print, is a case in point. The Midsomer Norton firm has a history dating back 100 years, originating in business forms. And while the company still produces a huge amount of this type of product, and lays claim to being the market leader in integrated forms, these days the jobs are likely to be for the booming internet retail market as part of retailers’ despatch solutions.

“There’s a lot more e-commerce going on. People are looking at their supply chains and questioning who is adding value,” observes managing director Mark Cornford, who is seeing some movement from his traditional trade position that involves some end-customers wishing to deal with his business directly and cut out the middle man, or woman.

Integrity is also confronting structural change in one of its other markets, pre-printed paper for items such as bank statements as bills, where end clients are increasingly moving to ‘white paper in’ solutions. As a result the firm has diversified its offering into new areas such as labels, packaging and security printing.

Paragon Group’s separate trade printing wing, Print Trade Suppliers, faces some similar pressures. General manager Ann Harrington says: “A lot of our traditional products are threatened by technological change and customers choosing white paper solutions.”

But Paragon obviously sees opportunity in the trade space, and it acquired Print City just over a year ago to add colour print to its existing offering. “We are trying to differentiate ourselves by concentrating on customer service. We aim to be a low-cost but profitable supplier, because we want to be around for the long-term.”

At Swanline, the speciality is wide-format printing for markets including point-of-sale and packaging. And the firm represents another example of how trade printers are operating at the cutting edge of technology. Chief executive Nick Kirby says the Staffordshire business takes a “visionary” approach to investments. “We tend to invest in equipment so our customers don’t have to,” he explains.

“We are committed to new equipment right up to 2018 for products that are not on the market yet,” he adds. “Speed to market is key and also the ability to cut waste by producing exact quantities.”

Customer benefits

Trade customers can essentially be boiled down into two core groups: print managers and brokers, and other printers.

For some customers, particularly brokers, trade printers report that price is the be-all and end-all. “They will have multiple tabs open on their browser checking everybody’s prices and then jumping on the best offer,” notes one print boss.

“If I put a ‘10% off’ code on I can literally double turnover for that day, people are so price sensitive.”

Other print managers are looking for long-term partnerships based on reliability of service and quality.

“To be a successful trade printer you need to accept that the print manager is essentially part of your team, and you’re part of theirs. We support them because they’re our sales force,” explains Spin Print director Dan Brook.

And trade printers provide their commercial cousins with a valuable service when capacity constraints bite, or when an investment in new kit might not be warranted.

“We often produce overspill work for large campaigns, and we also have the latest equipment that an individual printing company wouldn’t necessarily be able to justify for themselves,” says Swanline’s Kirby.

Trade printers can also come into play when printers are thinking of adding new kit, or indeed getting rid of it altogether.

“Printers can build up an amount of work, using a service like ours, and can then work out at what stage a machine of their own becomes viable when they feel confident that the work is there,” says Harrier business consultant Julian Marsh.

And while it’s well documented that many ‘high street’-type print operations have ditched their litho presses in favour of digital kit, using trade suppliers for their litho work, some are even doing the same with their digital presses.

“The litho option means they can sell a higher specification product and buy it at a lower price than they could make it themselves,” says Grafenia’s Gunning. “Now some people are starting to say that they are going to get rid of their digital kit, because they’ve got to staff it full-time and fill it, and that can become a burden.”

Indeed, Belfast’s Northside Graphics is expanding its DigitalPrinting.co.uk offering with a new dedicated service offering trade digital print via the aptly-named TradeDigitalPrint.co.uk site that is set to go live later this month.

“We believe there’s definitely an opportunity for a proper trade site that really is just for the trade,” he says. “The key difference to most online offerings is that we’re not tailoring production to what we want to produce, we’re tailoring it to what the customer actually wants.”

Despite stiff competition the large and dynamic trade printing market appears to offer sizeable opportunities for those with the right set-up and model.