As the motorway’s elevated section snakes through Brentford, a huge poster site on the side of the old Alfa Laval tower looms into view, providing an enormous canvas for major brands to promote their wares.

It is surely no coincidence that the biggest and most valuable brand of all – Apple – seems to have taken up permanent residence on this BlowUp Media site, using the vast 474m2 expanse to promote the capabilities of its latest iPhone.

Posters for out-of-home advertising are undoubtedly one of the most long-standing and familiar areas of large-format print.

But the whole wide-format market has undergone a revolution in recent years, as any visitor to the various Fespa exhibitions will attest – the possibilities presented by the latest technology, most notably large-format digital printing and clever finishing devices such as cutting tables, has opened up a veritable cornucopia of potential business opportunities.

And gone are the days when there were sizeable barriers to entry, such as a requirement to invest in expensive VLF litho presses or big screen printing lines.

Exploding market

Print’s digital revolution has torn down those walls, and the advent of highly-affordable large-format digital printing kit has made this market an accessible option for printers of all shapes and sizes.

The challenge for large-format printing specialists, then, is picking the right products or markets to focus on. And that can be tricky in a sector that spans a huge variety of applications, from posters to building wraps, point-of-sale, vehicle wraps and everything in between.

The opportunity for personalisation and mass customisation is also highly relevant, such as consumer demand for unique wallcoverings. And the ability to print short runs and one-offs means that items such as individual store window displays become viable.

“Digital printing has no memory. You can produce one after another, each totally different, and far more economically than in the past,” says Lascelle Barrow, joint managing director at London’s Augustus Martin, who sees the possibilities as boundless.

“You see lift doors that are printed, and when you think about the number of elevators in the world that’s an enormous potential market,” he adds. “It all comes down to how people will sell that product. Firms can create their own niches.”

This explosion of opportunity has also, somewhat predictably, resulted in an explosion of competition. “The machines are getting a lot easier to run. Everyone puts the latest kit in, and it’s a very competitive market,” notes Phill Reynolds, managing director at Cheadle Hulme-based Cestrian.

“It’s what you do with the equipment that counts and that’s what differentiates us,” says Reynolds, who describes the commodity large-format market as “ruthless”.

“We’re not just putting ink on paper or board, it’s ruthless out there and we stay away from that. We are differentiating our offering through innovations.”

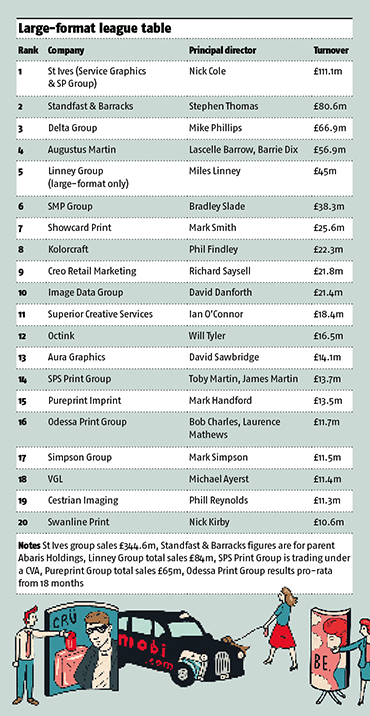

And with high-street retailers in particular under pressure, that squeeze is filtering down to suppliers. Recent trading statements from St Ives, which tops our league table with sales of over £110m, have cited “increasing price pressure” from its big-name grocery point-of-sale and display clients.

While the retail market has probably never been more competitive, this also results in opportunity, believes Mike Phillips, chief executive at London-headquartered Delta Group.

“When there’s lots of money sloshing around, mediocre companies can perform. But when things are difficult the good companies get to prove how good we are,” says Phillips, who clearly relishes the challenge. “In times like this procurement departments have more teeth, and they are checking whether suppliers deliver and produce good ROI. When times are difficult, as it is now, we tend to do well.”

A time of adversity also resulted in the growth of a major new business area for Brentford-based Octink, after the financial crisis of 2008 caused the company to reassess its entire offering.

“We did an evaluation and looked at what expertise we had in-house, and how that could be monetised,” recalls chief executive Will Tyler. “We realised we had skills we weren’t promoting, and project management expertise that we weren’t monetising.”

As a result, Octink developed its offering in producing marketing suites for housing developments – and as it happens the firm has a ready market pretty much on its own doorstep at the moment as the Brentford area of west London is in the throes of a huge regeneration project.

“In construction it’s all about compliance, there’s an enormous amount required before you can even enter a site,” Tyler explains. “We maintain that at a very high-level as a matter of course, and the client can mitigate any risk by putting the project into one safe pair of hands – we de-risk it for the client.”

As well as helping the firm build a substantial offering in the production of marketing suites, Tyler says that operating with such a high level of compliance for its construction clients has had knock-on benefits in other markets. “We maintain it as a matter of course, so we find it easy to get past any other compliance issues that are put up in other areas, such as retail.”

Customer demands

Unsurprisingly, the customer demands that tend to dominate in large-format typically involve more cost-effective solutions, faster turnaround times, and innovation.

Nowhere is that more evident than in retail. “Retail conditions are challenging and cost is always going to be a major consideration,” says Richard Filmer, print operations manager at Arcadia, the owner of brands including Topshop, Topman, Burton and Dorothy Perkins.

“We like to work with suppliers who think outside the box and come to us with suggestions about alternative ways of doing things, and what’s new on the market.”

Filmer says that it also pays for suppliers to take an active interest in their clients’ businesses.

“Some of our suppliers know our stores and will look at them and suggest ways of doing things differently. Innovation is requisite,” he adds.

Augustus Martin’s Barrow observes that the sort of specialist large-format graphics that were once used only for flagship stores “are now in every high street”, which is good news in terms of volume for print suppliers, but it means the search for the latest innovative offering is a constant quest.

Large-format specialists have tuned their offerings as a result of these demands.

Cestrian’s Reynolds describes the firm’s mode of operation as “a combination of pitching ideas but also listening to our clients”.

“Whether it is textiles or rigid materials a lot of clever thinking goes into producing the end-result. And our average turnaround is now three days and that’s for huge accounts.”

“Turnaround times only ever go one way,” agrees Delta’s Phillips, who says that added-value services beyond print are also becoming increasingly important. The group has operations in Dublin and Los Angeles, as well as a creative agency, Lick.

“People still need and want print, but it’s not a door opener. They want data and other services, such as creative and shopper marketing,” he says. “The holy grail is to have all of it plus a full international service offering.”

In a similar vein St Ives reorganised its offering and set up its Marketing Activation division last year with the aim of cross-selling its range of services more effectively. “A lot of our new business development wins are now across Marketing Activation. We do surveys and field work via Tactical Solutions, creative and manufacturing at SP and Service Graphics, outsource other products via SIMS and present to the client as a single entity,” says group managing director Nick Cole.

Digital media impact

The large-format print sector is not immune to the threat of replacement by digital media technologies. As it happens, that same high-traffic M4 and then A4 corridor mentioned at the beginning of this article also showcases a potential threat to the medium. It has become a prime location for the latest digital screens, with the iconic Cromwell Road poster site now taken over by digital advertising hoardings.

But the good news for large-format print exponents is that it seems we’re still a long way off the sort of Blade Runner-esque future where huge screens dominate. And the likelihood of there being a high-res screen that can match the size and impact of that BlowUp Media site any time soon seems somewhat remote.

“Yes, digital screens are having an impact on the poster market, of course they are, but they will never take over from printed products,” asserts Augustus Martin’s Barrow. “Digital screens work on high-traffic areas like the Cromwell Road, but it’s rather different if you live in, say, Huddersfield. You still have a lot of posters being used in areas that are less populated.”

And some of those poster sites can almost look like screens. “Nowadays we can produce one-piece backlit posters and they are very impactful,” Barrow adds.

The increasing use of digital screens in retail environments also presents opportunities. Linney Group, for examples, operates thousands of screens in its clients’ stores and restaurants as part of its value-added services offering.

As evidenced by our league table, the large-format market is certainly big business, and in some cases just how big is not always clear. DS Smith, which acquired £21.8m turnover Creo Retail Marketing in June, already had a substantial large-format printing operation but doesn’t split out the results. And Icon Display, which posted turnover of £54m after producing a huge amount of work for the London 2012 Olympics (sales in a ‘normal’ year were closer to £20m), has since become part of owner Chime’s CSM Sport & Entertainment business. Separate results for the business are now unavailable.

We can expect further M&A in the sector, and Delta’s Phillips for one is determined to grow his business either through acquisition or indeed being acquired. “We’d like to be part of a larger group, or spearheading a larger group with an international footprint,” he states.

The overriding view among large-format printers is that theirs is a world of opportunity – an astonishing 80% of respondents to Fespa’s latest Print Census (see boxout) said they felt optimistic about their prospects. And such optimism seems justified in an era where it’s possible to print onto pretty much anything, at any size.

As Barrow points out, with the sage wisdom acquired over more than 50 years in the business: “We are only limited by our imagination.”

Fespa Print Census: key trends

The Print Census is Fespa’s ongoing research project to find trends and insights into the wide-format print sector. Key findings of last year’s survey were:

- The feel-good factor – 80% of respondents (representing printers from Europe, Asia, Africa and the Americas) said they were optimistic for their businesses

- Customer demands – print is a service industry. Service is a true differentiator, and it means far more than delivering on time, on specification

- A changing product mix – from mass production to mass customisation. We can expect to see a further shift away from commodity products and towards customised, high-margin applications

- Digital printing technology is the change enabler. The motivator for most buyers is their ambition to move into new markets with new products or services, such as textiles

- Textile print growth in graphics, garment, decor and industrial markets

- The future of sign and display printing is integrated with digital media. Printed and electronic displays are likely to be mixed to deliver maximum impact and functionality. The wisest printers will be ready to advise customers on how to blend both solutions to achieve their objectives

Source: Fespa