The biomaterials group had already made dramatic changes in its paper business after deciding to convert its entire Lumi coated woodfree paper production – also more than one million tonnes – to packaging board.

It has now announced plans to shut down both Veitsiluoto and the Kvarnsveden Mill in Sweden during Q3 this year. Both mills are loss-making.

The plans will reduce its paper sales by around €600m (£517.4m) and slash the group’s annual paper production capacity by 35% to 2.6m tonnes.

The group’s Paper division would subsequently represent just over 10% of overall sales.

Stora Enso said that paper demand in Europe had been declining for over a decade, with the Covid-19 pandemic further accelerating that trend. Significant overcapacity in the European market had resulted in “historically low price levels”.

Veitsiluoto has three paper machines and an annual capacity of 790,000 tonnes. It makes woodfree uncoated paper for office use, while one machine makes coated paper grades used for magazines and packaging.

The mill also has a 360,000 t/a integrated chemical pulp mill, which is also set to close. Its sawmill would continue operating as part of Stora Enso’s Wood Product division.

Kvarnsveden has an annual capacity of 565,000 tonnes and runs two paper machines making supercalendered magazine papers and improved newsprint. It also has an integrated softwood thermomechanical pulp (TMP) mill with a 900,000 tonne capacity, also slated for closure.

The sites employ 670 and 440 staff, respectively, resulting in a potential 1,110 job losses.

A merchanting source commented: “I didn’t see this coming but I guess we all thought something else might happen when they closed down their coated mill. This will definitely have an effect on the UK market, the question is who will step in to take on that business?”

Although Stora Enso emphasised that no final decisions would be made until consultations had completed, the group’s top management also said they had explored other possible options – such as conversion or divestment – without finding a feasible solution.

President and CEO Annica Bresky said it was “heavy news” for the company and employees, and said staff had “done their utmost during very difficult circumstances”.

In a briefing explaining the situation, Bresky stated: “This is a market-driven plan. Our products are simply challenged from a market perspective and profitability is simply not there,” she said.

“We completed internal studies and came to the conclusion, from what we’ve seen in the past year and the situation moving forward, this is the new reality.”

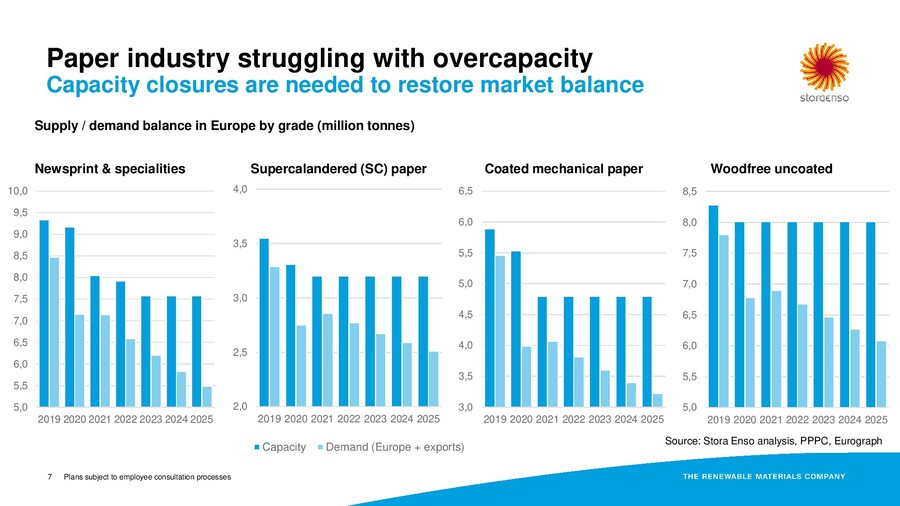

Bresky said that there was currently 3.5m tonnes of overcapacity in Europe.

“That means approximately 15 machines of an average size need to be closed,” she stated.

Stora Enso cited overcapacity in Europe across a range of graphic papers

She said that previous changes had been “simply not enough to correct the gap between supply and demand”.

Bresky also said that she hoped some of the affected employees would be able to take up alternative roles at other Stora Enso sites.

The move is expected to involve some €104m in restructuring and redundancy costs and a €127m impairment charge for the €8.55bn-turnover group.

Mario di Lieto, the former managing director of the Lumipaper business in the UK, said he believed the closures would be viewed as one of the consequences of the pandemic.

He told Printweek: “We have seen in various industries accelerated changes. Evolutionary changes that a year ago were seen as a decade plus in the future, are becoming today’s revolutionary changes. This looks like another step towards the digital communication interface.”

Stora Enso’s sales fell by nearly 15% last year. At the time its Paper division accounted for 23% of sales but the division became the group’s biggest loss-maker when it swung from making a €213m operational EBIT to a €38m loss by the same measure.

It plans to shift production of some of the affected products to other mills, with details to be confirmed. "We plan to support our customers in this potential transition by offering alternative grades wherever possible," the firm said.

Stora Enso makes woodfree uncoated office papers at its Nymölla Mill in Sweden; supercalendered papers at Langerbrugge Mill in Belgium and Maxau Mill in Germany; machine finished coated papers and coated and uncoated book papers at Anjala Mill in Finland; standard newsprint at Langerbrugge Mill in Belgium and Hylte Mill in Sweden; and improved newsprint and other newsprint specialities at its Anjala Mill in Finland and at Sachsen Mill in Germany.