Publishers will also become less identified towards a single medium and will repurpose content into a multitude of media, according to Publishing in the Knowledge Economy, the Pira report commissioned by the DTI.

Piras business manager for print and publishing, Richard Gray, said that while magazine and newspaper printers were in essentially mature and static markets, they could diversify to exploit the opportunities surrounding content delivery. On the other hand, publishers would no longer be publishers of books or magazines, but content.

"I dont think that magazine printers will offer digital print or asset management in the same plant," he said. "But they may have subsidiaries that could provide a more rounded service. They may offer e-mail or direct mail services as well."

The report suggests that while Britain enjoys a healthy publishing industry, which at 22bn is twice as big as the pharmaceutical sector, the future for some traditional print sectors will be stagnant.

According to Pira, newspapers advertising revenue will fall by 5% and outdoor posters by 1% over the next five years. The brochure and magazine sectors will also decline slightly.

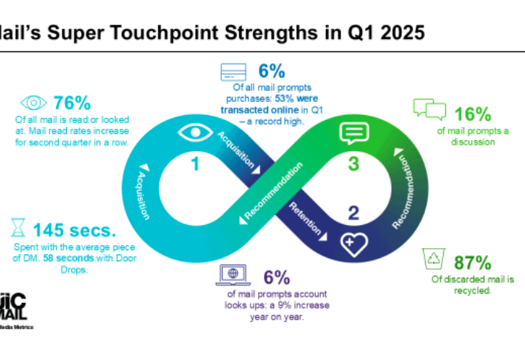

The exception to the mature print market will be the direct mail sector, which is predicted to rise by 5%.

"Direct mail will grow with the advances in software and digital print," said Gray. "Publishers may want to communicate with the user in more than one way."

Story by John Davies

Have your say in the Printweek Poll

Related stories

Latest comments

"'Support our ongoing growth? Growing in a declining market = more market share, and is last man standing strategy. That worked equally as well for Polestar...."

"Maybe now is the time for those publishers that rely on these guys to help them out for a change. No one left in the pub but the brawler who's knocked everyone out and now can't get a..."

"Another sad day for the industry, only made worse after reading that Ian Shenton is heading up the rescue bid... This guy has had more failed takeovers than Santa has reindeers. Just search on..."

Up next...

Investor exit 'not unexpected'

Walstead Group being put up for sale

Replaces the Pro C5300 series

Ricoh enhances usability and print quality with new range

Impressed with quality

Kall Kwik WGC boosts capabilities with new Revoria

Volumes on JICMail’s panel increased by 5%