Business

Baesman Group continues local acquisition strategy

Looking to solidify its position in a little known but key direct mail market, Columbus, OH-based Baesman Group this week acquired Vincent Direct, also of Columbus. The move comes only a few months...

Nipson eyes growth in US and UK but Drupa isn't part of strategy

After a tumultuous few years that saw it work its way through administration and divest itself of a key investor, Bryan Palphreyman, new head of Nipson SAS US and UK operations, said the company is...

EU late payment law may do SMEs more harm than good

If you strip down any business failure, the chances are that poor cashflow is ultimately blamed for the demise.

Middleton takes on De La Rue role

Trinity Mirror managing director of manufacturing Rupert Middleton will move to De La Rue next month.

Own-X unveils Memjet-powered Widestar 2000 printer at Labelexpo

Own-X has unveiled a new high-speed wide-format printer, the Widestar 2000, which is capable of single-pass, full-colour printing, at this year's Labelexpo event.

Rival buys Richard Edward, employees in consultation

Staff at Richard Edward, the London-based specialist playing cards printer, have been placed in consultation following the company's acquisition by games manufacturer Cartamundi.

Burke calls for sustained industrial action to rescue UK

Unite assistant general secretary Tony Burke has called for sustained industrial action to protect UK workers.

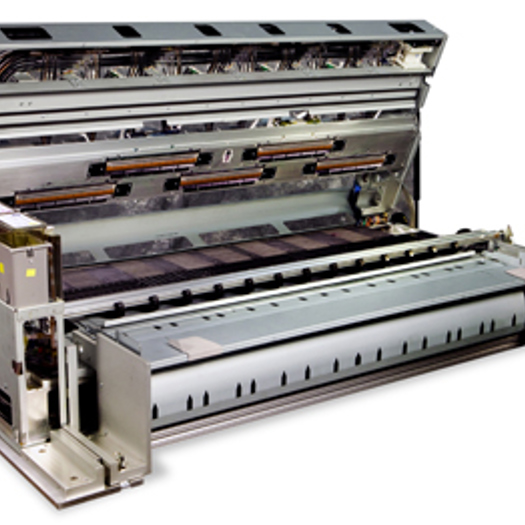

Heidelberg to exhibit CSAT and Linoprint printers at Labelexpo

Heidelberg is exhibiting CSAT products under its own umbrella for the first time at Labelexpo, following its acquisition of the German digital press manufacturer in August.

Miraj Multicolour installs Rajasthan's first Alpha RF automatic exercise book production machine

Rajasthan-based Miraj Multicolour has commissioned its first fully automatic exercise book production machine Alpha RF from ECH WILL at their stationery manufacturing plant in Udaipur.

Kodak investors 'spooked' by $160m debt draw

Kodak's shares shed a quarter of their value on Monday (26 September), closing at $1.74 (1.11), after the company announced a $160m draw down on its revolving credit facility.