Recent seismic events involving the demise of Polestar – which was the country’s biggest commercial and publications printer – have certainly proved one thing. It seems there’s no such thing as a straight up and down web offset market anymore.

Rather, there’s a market for long-run products, says Wyndeham Group chief executive Paul Utting, and these products might be produced using any number of printing technologies.

“The Polestar debacle has proved two things: it’s a European market, and it’s not just a gravure or web offset market. There’s a market for long-run printing,” he states.

“If you were to shake all of the supplements out of the newspapers you have got heatset, coldset, and gravure in there, and as a punter you don’t care how it has been printed.”

Events at Polestar have indeed seemed to result in a blurring of the old divides. Some work that was gravure printed at the group is now being printed web offset. Some titles that were produced web offset at Polestar are now being printed gravure, while other work has switched to in-house coldset production at the print plants of Polestar’s former newspaper customers. And some of the group’s other work has migrated further down the print food

chain and gone from being printed web offset to sheetfed.

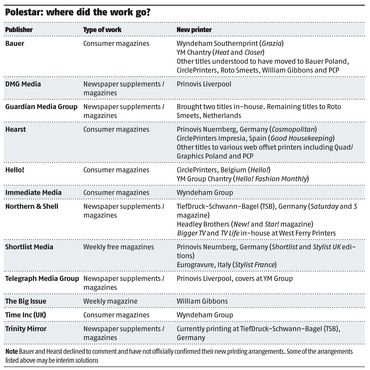

What’s also incredible is that, despite some obviously fraught circumstances for some publishers in particular, circa £90m of turnover from the now defunct Polestar Sheffield web and gravure operation has just been absorbed elsewhere – not all of it in the UK, admittedly (see boxout, below). But it has all found a home with a remarkable absence of ructions.

“What this has shown is that everyone has a choice and it is a pretty big industry,” adds Utting.

So where has the work gone? One of the biggest winners has been Prinovis in Liverpool, which is now the UK’s only publication gravure printer. Having absorbed the DMG Media work that initially looked like it was headed to the continent, as well as the Telegraph supplements, the plant is “pretty full” according to an insider.

And it could well be the case that, as predicted by Mark Scanlon, chairman of Wyndeham owner Walstead Investments, close to £100m of work has indeed migrated to the continent. Whether it will remain there is another matter.

Wyndeham Group has also picked up a substantial amount of work, along with an additional web offset site in the shape of the former Polestar Bicester operation, now Wyndeham Bicester. Key client Time Inc (UK), which was faced with the prospect of being unable to publish some of its titles after Polestar’s collapse, has helped bankroll Wyndeham’s purchase of Bicester’s assets.

Bicester was understood to have had turnover of circa £40m under Polestar, but the terms of the buyout deal meant the site effectively started afresh with an empty order book under its new owner. It is understood to be operating at a run rate of around £25m at the moment.

And YM Group – the owner of York Mailing, Pindar and Lettershop – has made a substantial move into publication printing with the purchase of the former Polestar Chantry facility in Wakefield, now renamed YM Chantry.

It means that YM Group replaces Polestar as the biggest web offset printer in the country, with Wyndeham potentially vying for top spot depending how the Bicester business progresses. Such figures, though, are also complicated by issues such as the amount of paper that is supplied by clients, which inflates headline turnover.

YM Group chief executive Stephen Goodman is bullish about the firm’s prospects in magazine printing, because he believes the outlook is significantly rosier in a post-Polestar world.

“It is a sizeable opportunity. UK capacity has dwindled massively and we believe there are opportunities there for us,” he states.

The Chantry site suffered while Polestar was in its death throes, as some of its titles were moved to Sheffield in an attempt to keep that plant going. “Chantry was a £40m business at one time, although it is a lot less than that now, and we are planning to get it back to that £40m level,” explains Goodman.

Despite the migration of work to the continent, he believes there are still good prospects for UK print suppliers.

“Publishers are still running to tight deadlines and the information has to be fresh and relevant. There are a lot of products that have got to be printed in the UK.”

New investment

YM Group is still planning to increase its existing web offset capacity: it remains interested in the 64pp short-grain Goss M5000 that is currently mothballed, alongside the two 96pp long-grain presses, at the shuttered Polestar Sheffield site.

“We’re investing for growth and keen to get the 64pp short-grain. If we do not get it, we will look at other options because we need to increase our print capacity,” Goodman says.

The group has bought two of Sheffield’s Ferag lines and two of its polywrappers to add stitching at Chantry, and has also acquired the automated platemaking line from the site.

It had already installed a new Ferag system at its Pindar facility in Scarborough earlier this year, and Lettershop in Leeds has recently installed a 32pp Goss Sunday 4000 press to produce its trademark special products.

Equipment moves are afoot elsewhere, as well. Garnett Dickinson in Rotherham has acquired the 48pp Sunday 4000 press from Artisan, which closed down in 2015.

Chief executive Nick Alexander says: “We made the decision before the Polestar news. Our strategy was set 15 months ago. We have reduced our product range dramatically and are targeting high-quality products that are suitable for our kit.”

The M4000 is being installed now, and should be up and running by the end of July.

And the William Gibbons 16pp supersite in the West Midlands is also poised for expansion – its ninth Komori System 38 web arrived last week.

Managing director Mark Gibbons described the world of web offset as “a rollercoaster”.

“It’s the normal rollercoaster, nothing’s changed. It’s been obvious that Polestar couldn’t survive. The only question was when,” he says.

Again, William Gibbons had decided to buy the new press long before the demise of Polestar.

“We’ve always believed in ourselves and the growth of our business and we will continue to invest to look after the needs of our clients when the time is right,” Gibbons adds.

The new Komori is scheduled to start running on 1 August.

However, despite this additional capacity, the overall picture in ‘UK Web Offset PLC’ is one of vastly reduced capacity.

Manroland Web Systems sales director John Ellis calculates the install base in 16pp web equivalents, and his figures – excluding the three huge web presses currently mothballed at Polestar Sheffield – point to a reduction in overall capacity that is the equivalent to nearly 60 16pp webs from 2015-2016 alone.

Buying squeeze

This capacity reduction is likely to pose some challenges for buyers in the future.

Simon Biltcliffe, chief executive at print management business Webmart, says better forward planning will be vital.

“It’s going to be very tight from September onwards, so if customers are not booking in soon or now, they’re going to be at the back of the queue.

“Those dragging their heels are going to find it difficult to contain costs,” he warns.

Biltcliffe also looks at the market in terms of the Europe-wide web offset offering. But while he asserts that transport is not necessarily a huge issue in terms of time and costs, the Brexit-induced fall in the value of the pound could have a big influence in dampening enthusiasm for continental print solutions.

“When a market changes all sorts of unorthodox thinking has to take place. People are going to have to think about new ways of achieving what they want to achieve and new ways of doing that.”

Anecdotal examples include mail-order customers re-engineering their products in order to meet pre-existing budgets in the face of an increase in print prices. There is also speculation that some magazine titles could be rendered unviable without the benefit of Polestar pricing levels.

“There’s a realisation from publishers and print buyers that things have got to change if they want a secure supplier base in the UK. I’m hoping for a realignment of capacity and pricing that will be better for the longer term,” says Precision Colour Printing’s managing director Alex Evans.

However, despite reports of some customers facing price increases of 20% and even more than 30%, some printers have also apparently been happy to match Polestar’s rates.

“There are still some pretty keen prices out there and customers have still got choice,” says Eclipse Colour managing director Simon Moore. “There’s still a reasonable amount of capacity in our arena but we’ve started to see a lot of activity from the end of July through August. We will have to wait to really understand the effect of the demise of Polestar until we get to that period.”

And what will happen when it comes to producing the monster Christmas TV listings magazines later in the year? Last year this involved some 2,800 tonnes of paper, 8m magazines and the equivalent of over 47m 32pp sections.

Buyers be warned, come autumn it’s likely there quite simply won’t be enough capacity: “The commercial web offset market is going to take a hit as a result,” says one print boss.

Gibbons takes a typically pragmatic view of the situation. “The market is just the market. People won’t change their buying habits of a lifetime, there’s just less of us to buy from.

"There’s still an amount of print to be produced and an amount of printers that can produce it – the rest of us are still here and just have to get up and get on with it. This is still a very vibrant business in a vibrant market.”

Life without Polestar, then, is going to be completely different – apart from the bits that are just the same. But the new world order in web offset should be good news for the remaining printers.

WEB OFFSET LEAGUE TABLE