The group, which is the biggest distributor of paper, packaging, and sign and display materials outside of the US, has been working to establish a new shareholding structure since February, and its majority shareholder Sequana, which has a 75.21% stake in Antalis, went into liquidation in May.

Over the intervening months industry sources have suggested a number of potentially interested parties, including Europapier Group, and Japanese paper groups OJI Holdings and Nippon Paper, which acquired the former Paperlinx business in Australia.

In the statement released today (20 December), Antalis said: “The objective of this process is aimed at putting in place a new capital structure providing Antalis with the necessary financial flexibility to consolidate its strategic positions in paper distribution and pursue its transformation towards packaging and visual communication.”

The company added it “will inform the market of any significant developments”.

Antalis had refinanced in 2018, according to its financial reports released for the year.

The business signed the legal documentation to complete the refinancing of its €285m (£243m) syndicated credit facility and its main factoring programme for an amount of €215m, respectively, on 31 May and 27 June 2018.

Antalis said these refinancing agreements – which are secured through 31 December 2021 – would enable it “to pursue its external growth strategy”.

At the end of last year, the group had debt of €412.8m, up from €364.2m the prior year.

According to Antalis’ half-year results for 2019 published in September, the amount authorised under the group’s main factoring contract was raised from €215m to €290m after the agreement was amended to include an additional financial partner. At this point the firm’s net debt stood at €433.6m.

Shares in €2.3bn-turnover Antalis were flat at €0.83 in early trading this morning and remained so at the time of writing.

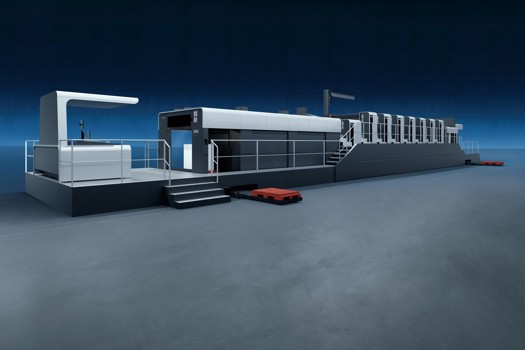

Separately, Antalis’ Visual Communications division has added Katz Display Board to its sustainable product portfolio “in response to increasing demand from customers looking for more sustainable alternatives to plastic-based products”.

Billed as an environmentally friendly alternative to the use of PVC and PUR foam boards for retail and POS applications, Katz substrates are developed to withstand store conditions, including variations in temperature and humidity.

Katz Display Board in 3mm and 5mm options and standard 2,440x1,220mm are now available from stock from Antalis, with bespoke sizes up to 2,650x1,500mm available to order.