The trend is also true for the print industry, according to Brendan Perring, general manager of print association the IPIA, who told Printweek that in his opinion insolvencies were happening “at the fastest rate in the print industry since the aftermath of the 2008 ‘credit crunch’ recession.”

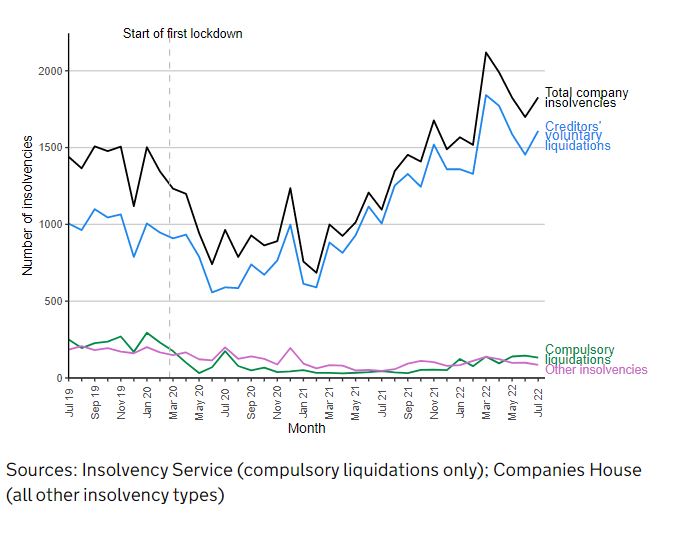

In the wider economy, this trend has been driven by a 60% leap in creditors’ voluntary liquidations (CVLs) between July 2021 and July 2022, to 1,609 - a total also 60% higher than pre-pandemic level in July 2019.

This leap in voluntary liquidations suggests that a growing number of company directors are choosing to close their businesses, perhaps due to current economic conditions, according to Christina Fitzgerald, president of insolvency and restructuring trade body R3.

“In recent months, economic pressures have been hitting firms from every angle,” she said, adding that inflation remains high, the economy is shrinking, consumers are losing confidence and many firms are struggling with the labour shortage.

Ian Carrotte, proprietor of ICSM, a business intelligence group which looks out for bad debts and late payers within printing and similar industries, said the group had noticed an increase in the number of printers failing since the end of lockdown.

This, he told Printweek, is in part due to coronavirus loans falling due at a time of massive change in the industry. In consequence, Carrotte said, ICSM’s debt collection service has “never been busier.”

Printers’ difficulties with high material and utility costs and lost revenues during the pandemic have made it an even more challenging time, according to Perring.

“It’s not just one factor behind this,” he said.

“A lot of the insolvencies are concentrated in a certain band, which is perhaps B2 printers, or those who had really built themselves around being a jobbing long run printer, more heavily reliant on litho work, and needing fine margins on long runs to make profit.”

These vulnerable printers, Perring added, are often “entrenched” in their market because they have previously enjoyed success there. Given the pace of change within the industry, however, many are simply unable to diversify in time, especially after the pandemic’s destructive effect on revenues.

When Perring joined the industry in 2010, he said, printers would on average look at a five-year diversification project - nowadays, he said, that diversification would need to happen in as little as six months.

Many businesses may simply be unable to afford the change, either: research by personal finance company Nerdwallet found that a third (33%) of UK SMEs said their survival was dependent on accessing finance by the end of the year.

More than two-fifths (41%), however, said that they found that finance less accessible than it was in 2021.

While the difficulties are severe, Perring said, there are places that print can thrive.

“It’s really difficult, because there are growth areas in print.

“There are lots of areas where our industry can move into and can adapt and have a bright future putting ink on substrate, but it’s going to be a lot of adaptation and flux for another 10 years until it starts to come down, and we find our place again.”

The significant changes in the industry and economy also present opportunity, according to Carrotte.

“I have seen four recessions in my time in business, and the one thing I tell members of ICSM is that if you can survive in the toughest of times then you can prosper in the long-term.

“And there are opportunities in the printing industry for those who are quick on their feet. We have seen a rise in packaging, label printing and even book publishing – long thought to be in long-term decline.”

Similarly, the businesses failing will include ‘zombie’ firms who were in trouble before Covid, and whose dissolution would benefit the industry, according to Carrotte.

“That means the market opens up for the print firms who are left, and in the long-term survivors will benefit from an increase in profit margins as some competitors fall by the wayside.”