The sale has a cash value of 7.6bn, and will involve Koch assuming Georgia-Pacific's 4.4bn debt. Debt financing has been secured by Koch through Citigroup, which advised the company on the acquisition.

Koch Forest Products, a subsidiary of Koch, made a 28 per share cash offer for all the paper and packaging manufacturer's shares on 11 November.

Both sets of directors approved the deal, which will lead to Georgia-Pacific becoming a wholly-owned subsidiary of Koch.

The firm will continue to trade under the Georgia-Pacific name, and will operate as an independently managed company.

Georgia-Pacific is one of the world's leading producers of pulp, paper and packaging board products. It has UK operations in Bolton and Sheffield.

The firm employs 55,000 staff across the US and Europe and has annual sales of around 11.5bn.

Koch Industries is based in Kansas, and has interests in companies trading in pulp and paper, petroleum, chemicals, energy, fertilisers and securities and finance.

Have your say in the Printweek Poll

Related stories

Latest comments

"Gosh! That’s a huge debt - especially HMRC! It’s a shock that HMRC allowed such an amount to be accumulated."

"Whatever happened to the good old fashioned cash job! At least the banks didn't take 2-3% of each sale. After 30 odd transactions that £100 quid you had has gone."

"It's amazing what can be found on the "web" nowadays!"

Up next...

Turnover boosting wins

FDM in bumper triple contract win

Interim boss already in place

Royal Mail chief executive quits

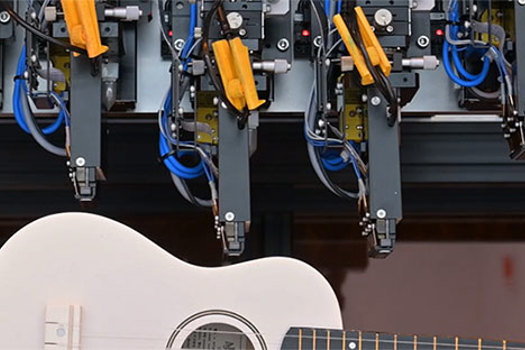

Prints onto complex objects