Steve Coburn, market manager for transactional documents at Scitex Digital Printing, said consumers would retain statements and look at them time and again, thus increasing the effectiveness of personalised marketing. They would also be expecting the statements so would be unlikely to immediately dispose of them.

But many consumers instantly binned direct mail offerings without looking at enclosed material, he told a seminar at Xplor in Anaheim last week.

Full-colour variable data print volumes in the US are expected to almost double year-on-year until 2006, according to Toby Cobrin of Cobrin Consulting.

The 2001 volume of 810m impressions a year will rise to 6.95bn in 2004 and 21.55bn in 2006, she said.

Instead of looking at documents as fixed information we have to expand that to look at content, said Cobrin.

Quality is definitely getting better, especially with colour management.

The UK and Scandinavia were leading the way in Europe in the adoption of full-colour variable printing, she added.

But problems still existed, with the time to market for variable data printing still being about twice as long as fixed jobs.

Colour variable data printing was most prevalent in markets like banking, insurance and personalised car manuals, said Cobrin.

Another consulting group, Interquest, predicted that the proportion of variable data colour jobs would rise from 12% of the total transactional printing market in 2001 to 28% in 2004.

Story by Gordon Carson

Have your say in the Printweek Poll

Related stories

Latest comments

"Gosh! That’s a huge debt - especially HMRC! It’s a shock that HMRC allowed such an amount to be accumulated."

"Whatever happened to the good old fashioned cash job! At least the banks didn't take 2-3% of each sale. After 30 odd transactions that £100 quid you had has gone."

"It's amazing what can be found on the "web" nowadays!"

Up next...

Turnover boosting wins

FDM in bumper triple contract win

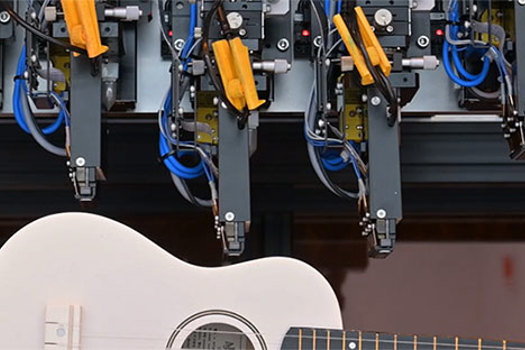

Prints onto complex objects

Epson brings new robotic DTO system to Europe

Replacement 'will be operational later this year'