Trade creditors are owed £2.7m.

The Leicester web offset printer was placed into administration with Deloitte on 14 May. The administrators said there had been a failure to secure a sale or refinancing of the business prior to that, following a “further prolonged period of underperformance against forecast”.

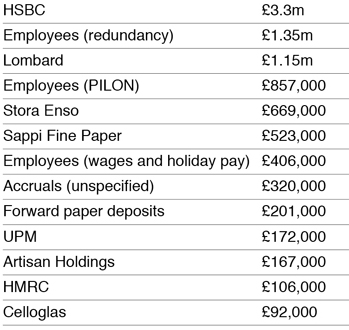

HSBC provided Artisan’s overdraft and is owed £3.3m, but despite being a secured creditor is unlikely to be repaid in full due to the value of the assets that make up its security. However, the HSBC bank debt is subject to a cross-guarantee with parent company Artisan Press Holdings, which owns the buildings Artisan operated from among other assets.

Artisan Press Holdings owns freehold property worth £9.9m according to the company’s latest accounts.

The administration has also thrown into question the ownership of 80 acres of farmland at Botcheson in Leicestershire, which could be worth more than £800,000.

In its report Deloitte said Land Registry documents point to it being owned by Artisan Press, whereas the firm’s directors believe it was sold to Artisan Press Holdings in 2003.

The value of farmland has rocketed in recent years, reaching a record high of £10,067 per acre last year, according to RICS.

Deloitte has launched a probe to establish the legal ownership of the land. It is also reviewing the £4.2m non-cash dividend Artisan Press paid to Artisan Press Holdings in October 2013. Holdings is controlled by the Sankey family.

Earlier this year, Artisan Press managing director Jonathan Sankey told PrintWeek the dividend payment was “an accounting adjustment” and emphasised it had not involved a transfer of cash between the businesses.

PrintWeek was unable to reach Sankey for further comment regarding Deloitte’s investigations at the time of writing.

Artisan Press employees were owed £406,000 in wages and holiday pay as preferential creditors, and the unsecured non-preferential claims included an additional £1.35m in employee redundancy claims plus £857,000 for payments in lieu of notice (PILON).

Other major creditors of Artisan Press include finance firm Lombard, owed £1.15m for Artisan’s newest Muller Martini Corona binding line, again with a cross-guarantee with Holdings.

As expected, paper companies are the largest trade creditors. Stora Enso is owed £669,000, Sappi £523,000 and UPM £172,000. Unnamed customers had also paid forward paper deposits of more than £200,000.

Unspecified accruals total £320,000.

Deloitte stated: “There is currently no prospect of any funds being returned to unsecured creditors.”

Management accounts for the period to 31 October 2014 show that Artisan had made operating losses of more than £8m in its last two years of trading. There had been a further 15% decline in sales at the business in the period, from £32.5m to £27.5m, and the operating loss was £3.4m (2013 loss: £4.6m).

Artisan Press ceased trading on 5 June. Wyndeham Group subsequently acquired its key bindery assets and has set up Wyndeham Binders operating out of Artisan’s former bindery unit.

Artisan Press – major creditors