The message was from Alok Sharma, Secretary of State for Business, Energy & Industrial Strategy. It implored businesses leaders to act now, because – quelle surprise – another Brexit deadline is looming and this time “there will be no extension”.

“Unless you take action, there is a risk your business operations will be interrupted. You should also check with your suppliers and customers that they are taking action,” he entreated.

No doubt this email, like the recent inflammatory statements from Treasury and Cabinet Office minister Lord Agnew, minister for the Cabinet Office Michael Gove, and PM Boris Johnson will have had business leaders up and down the country reaching for the blood pressure tablets.

Tim Rycroft, the chief operating officer of the Food & Drink Federation summed up the general sentiment perfectly with his sublime riposte to Lord Agnew’s recent ill-judged comments about industry bosses having their heads in the sand.

“I don’t think it’s accurate or helpful for ministers to assert that traders have not engaged in Brexit planning,” Rycroft stated. “If any traders have their head in the sand it’s because, after many frustrating months awaiting critical answers, they probably think it’s more likely they’ll find those answers in the sand than they will from the government.”

The good news for printing industry bosses is that printing industry suppliers have, as it were, kicked sand in Agnew’s face. Providers of mission-critical goods including paper, ink and plates have geared up, yet again, to make sure the essential supplies are available for the presses to keep turning.

This has come at not inconsiderable cost. A number of companies have jumped through the necessary hoops to achieve Approved Economic Operator status, including Denmaur Paper Media, Antalis and Premier Paper, as Nick Gee, managing director of Denmaur Paper Media explains.

“We have done everything we can in terms of registering for all the necessary, and gone one step further with AEO status, which we are told will help. We have also held regular updates with our supply base who are all as confident as they can be having twice prepared for the ‘no deal’ cliff-edge of the past two years.

“Without any accounting for the time element – and therefore internal human resource cost above that – we have paid in excess of £30,000 gaining AEO, and a further £5,000 to cover our team doing some customs training courses so that we are okay,” he adds.

Antalis UK & Ireland managing director David Hunter says that the merchant, which is now part of a global player Kokusai Pulp & Paper, has “been able to draw on our own experiences and knowledge of international trade to prepare for this event”.

Hunter says Antalis does not foresee any admin differences for customers.

“With regard to disruption at specific ports such as Dover, we expect greater impact on exports leaving the country than imports entering. We are working with all our suppliers to increase stocks in our own warehouses or in wharf locations to mitigate any potential disruptions. With an extensive national warehouse infrastructure, we are also working with suppliers to ensure we can be flexible regarding the port of entry should it be required,” he adds.

In his latest bulletin to customers Premier Paper managing director Dave Allen commented: “In addition [to AEO status] Premier Paper will be working with a specialist customs clearance agent to ensure the smooth flow of goods through ports where our suppliers are asking Premier to arrange goods clearance.”

Premier believes that European suppliers operating a ‘roll on roll off’ distribution model through the Channel ports “are most likely to see potential delays as even small delays to the flow of goods traffic could see an accumulation of traffic flowing through these ports in both directions”.

“This is where Premier sees the greatest potential for customs delays, even though HMRC and Border control have stated that they will not be stopping goods for customs inspection until July 2021. Premier has analysed which products are delivered by this method through Channel ports and will be taking steps to build stocks prior to 1 January 2021 to negate the potential negative effects of unreliable delivery times.”

Take stock

EBB sales and marketing director Chris Sandwell says that many continental paper makers have set up mechanisms to import paper to their own UK entities, prior to supplying EBB. He too, views stock holding as key until the situation becomes clear.

“In the short-term EBB has significant UK-based stock and maintains stock levels at eight weeks of average sales, so we don’t anticipate any immediate impact on supply. In addition a further 3,000 tonnes of wharf stock will be in place in the UK to support our own network,” he says.

“Distribution delays (if they occur) will be factored in to our reordering programme so as to mitigate additional delivery times from mainland Europe.”

The general advice to print bosses is to plan ahead. For example, parts that would currently be available on an overnight service, may take longer come January.

“We’ve advised our customers to make sure they have a good supply of parts, because we don’t know if things are going to get caught up in customs and it’s not possible for us to hold everything in stock,” notes one press manufacturer. “We’re saying to people sorry, we can advise you but we can’t do it for you.”

The situation is also affected by the complexities of modern supply chains. Fujifilm, for example, imports plates to the UK from its Tilburg plant in the Netherlands. But the aluminium to make those plates may have originated in the UK. Likewise the inks it manufacturers in Broadstairs can involve ingredients sourced from elsewhere in the world.

“There are so many complexities from components to the final product in the UK,” says UK general manager Andy Kent.

“We have thousands of SKUs, even just on plates, and while we have built up stocks – again – of our top selling products we can’t build stocks of absolutely everything. We are asking customers to let us know if they want something specific.

“The Covid-19 situation threw a lot of global logistics into difficulty and completely disrupted everything. Now we are through that disruption, just in time for Brexit,” he adds ruefully.

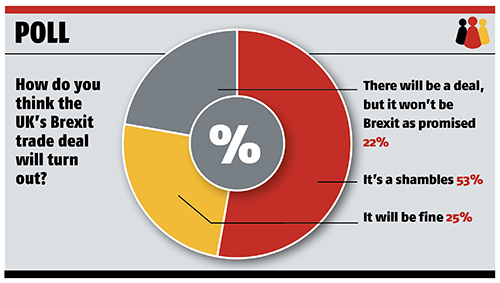

PRINTWEEK POLL

Another important factor is the potential for increased costs, and where the buck, or euro, will stop when picking up the tab.

Tom Bowtell, CEO of the British Coatings Federation (BCF), says: “With the clock ticking down on the Brexit transition period BCF has been working closely with members to help them get ready.

“There is a lot for businesses to still do in the short amount of time that remains available and we know our members are striving to prepare themselves as fully as possible. For instance, we know that members have been working their way through all the relevant UK Government and EU guidance in readiness for the new customs and borders operating procedures and regulatory regimes due to come into force from 1 January.

“BCF has encouraged members to check that their suppliers are equally aware of upcoming changes to minimise the risk of undue delays to raw materials and other goods and we know that some members are looking at building stock. No doubt these preparations will intensify over the next few weeks.”

Ink maker Flint Group manufactures coldset inks in the UK for its UK client base as well as for EU and export markets, and also sells EU-manufactured heatset and sheetfed inks into the UK market.

“Our main driver at this time is to ensure continuity of supply to our customer base. To this end our management teams are working extensively to ensure that all licenses and procedures are in place to cover whatever outcome presents itself,” says Tony Lord, president of Flint Group CPS Inks.

“We have serious concerns over the impact of increased complexity and costs in the supply chain. With new routings and longer lead times our logistics partners are forecasting increased costs in the region of 3% to 5%.”

Lord notes that these costs, plus any tariff that may need to be applied on both raw materials and finished goods, means the industry is “potentially facing doubledigit percentage increases, which for sure will limit or stop any Covid-19 recovery in its tracks”.

And, while Flint is “continually looking at mitigation of costs to ensure that we have a robust supply solution following many years of price erosion we would be unable to absorb any direct increased costs”.

Printers, then, should feel grateful for the Herculean efforts made by industry suppliers who already have more than enough on their plates dealing with Covid-19. But they should also be braced for some unknown unknowns come the new year.

Meanwhile, and also just as this issue went to press, Britain had resumed trade talks with the EU after a week-long hiatus. If Brexit was a box set we’d surely be on the final season now. The question is, after a prolonged four-and-a-half year ‘will they, won’t they’ drama, will the final scene be happy ever after or no deal?

OPINION

Our sector will adapt, but clarity is urgently needed

Charles Jarrold, CEO, BPIF

Charles Jarrold, CEO, BPIF

No doubt by the time you read this, the Brexit tale will have moved on again. We’re just past the government’s self-imposed deadline to do a deal or to have broken off talks. Sabres have been rattled, but talks are carrying on. And just as well – in any negotiation, accidents can happen, leaving better outcomes unrealised. The print community may have been somewhat divided on Brexit, and it was certainly split on what that meant – in the Single Market, in the Customs Union, in one, in both and so on. But, while not unanimous, I think it’s fair to say a significant majority sees a no-deal exit as really bad news.

Ours is not a heavily regulated industry, and, due to the positive view of the benefits of print to society, tariffs are low. We’re very used to free markets and open competition, and don’t fear liberalisation. So it’s tempting to think that no-deal will not affect us. Unfortunately, it almost certainly would, with significant challenges around transport to and from mainland Europe affecting both export opportunities and import of critical supplies – paper, ink, equipment. Tariffs may not be huge, but they add to the cost of business.

We’re also not yet post-Covid, and while demand has partially recovered, the typical feedback is that it’s at around 70% of the seasonal expectation. An untidy Brexit would put more pressure on the sector when it’s already facing lower demand, balance-sheet pressure and the withdrawal of the support measures that we all lobbied so hard for.

The government has listened to our feedback and has supported the sector during the worst of the lockdown, but it’s really important that we see at least a bare-bones Brexit deal done, giving the time, space and support to adapt to a world that looks so very different to what we expected back in 2016.

I don’t think our sector has anything to fear from the acceleration in business change that we are seeing, we have a long history of adapting to change and thriving, but dealing with a more disruptive than necessary Brexit – in the midst of a global pandemic – is a level of challenge that we could do without.

READER REACTION

Are you feeling prepared for Brexit?

Nigel Copp, founder and chief executive, KPM Group

Nigel Copp, founder and chief executive, KPM Group

“We’ve communicated with our suppliers and they’ve given their assurances as to the supply lines. I think the main impact [Brexit] has had is the uncertainty. If you go back to when the announcements and changes were made, and then with the changes in the government and the Prime Minister and everything else that went on, there were pauses in the industry, so everything went very quiet for a period of time and then it kicked off again. It would be good to have a bit more stability and none of these ups and downs going on.”

Zoe Deadman, managing director, KCS Print

Zoe Deadman, managing director, KCS Print

“We have spent quite a bit of time on it again, which is always annoying because it’s time that – especially now – could be spent elsewhere. We’re currently dug into rules of origin, commercial invoices and getting all of our paperwork in order for export, which is all quite complicated. We are stockpiling although we’re in our busy period for Christmas so finding the space is difficult, particularly this year because peaks and troughs are so distorted. We’re probably relying more on stockpiling by the merchants, and hoping that they don’t fall over with all of this.”

Stephen Docherty, group chairman, Bell & Bain

Stephen Docherty, group chairman, Bell & Bain

“We’re super prepared, we just make books and get on with it and that’s what we’ll continue to do. We’ve got a good supply chain – plates, paper, inks, we’ve ironed out everything from our main suppliers and I have no fears or worries whatsoever. We’ve not had to do much differently; we’ve always bought direct from mills and we’ve had relationships with them since the 1970s. We’ve had many discussions with external suppliers and they see no problems at all. I’m sure there will be a price increase somewhere but the price of paper never stays the same.”

Paul Brough, managing director, Bakergoodchild

Paul Brough, managing director, Bakergoodchild

“I think we’re as prepared as we can be. One of our main concerns is possible disruptions in the international postage market because we do quite a lot of international mail. The critical part of our supply chain is the paper supplies and I don’t know what the impact on paper prices might be – if we get a massive increase in the price of paper together with postal price increases, some of the marketing departments we’re dealing with are going to have to further justify the value of print, which we’re fighting heavily to do at the minute.”

Jacky Sidebottom-Every, joint managing director, Glossop Cartons

Jacky Sidebottom-Every, joint managing director, Glossop Cartons

“We’re advising our customers to lay down lots of stock material at the mill and to allow a lot more lead time just in case, to make sure that we’re going to get the board through customs and get it onto the presses. Our suppliers have all got it covered and they’ve all got contingency plans so we’re quite happy. Obviously it’s got to be about thinking on our feet and we’ve got to be pretty agile about it – if we need to look at perhaps bringing larger stocks in just before Brexit, then that’s what we’ll do.”