The federation’s new Printing Outlook survey describe demand and confidence being “decimated” in Q1 due to the impact of Covid-19 as the industry suffered a “dramatic shock” at the end of March.

The BPIF’s separate Impact Survey specifically around Covid-19 had already shown that the average drop in order levels was 65% during March.

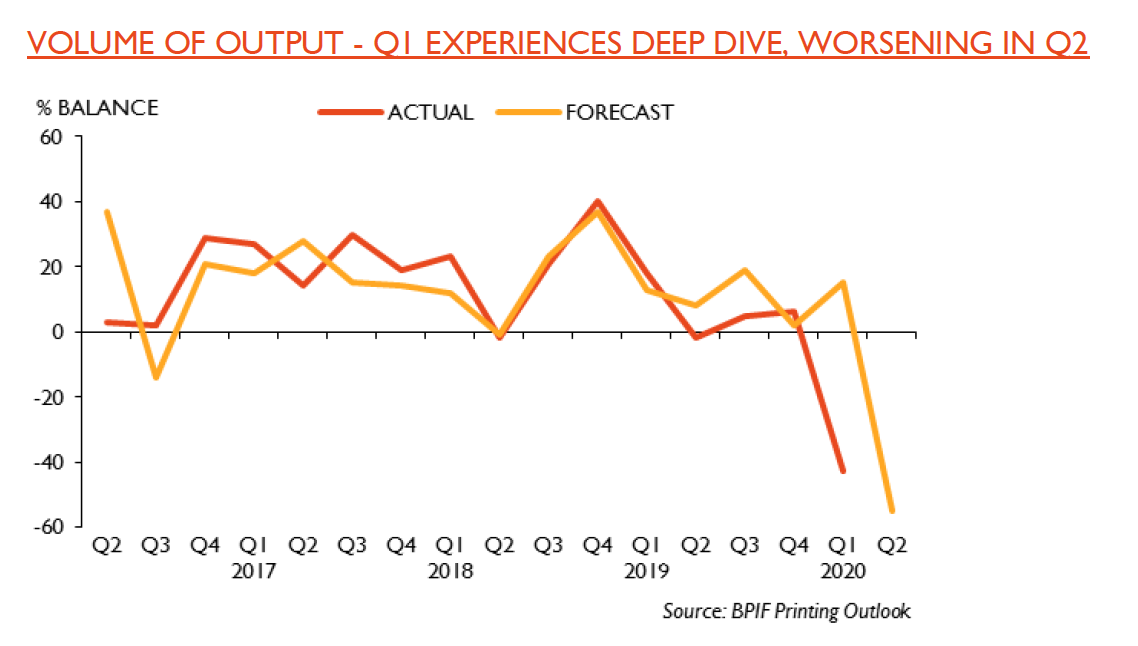

After two quarters of marginal improvements at the end of last year, the forecasted output balance of +15 for Q1 was wiped out as 60% of respondents experienced a decline in output. Just under a quarter of respondents (23%) held output steady, while 17% increased output levels. As a result of the dramatic decline, the Q1 balance was -43. This is the worst since Q1 2009 when the industry was dealing with the aftermath of the financial crisis.

However, it is Q2 that is expected to bear the brunt of the impact, due to the UK lockdown that was announced by prime minister Boris Johnson on the evening of 23 March.

“Almost 72% expect output levels to fall” the BPIF reported, which would result in a forecasted balance of -55 in Q2 – potentially a new record low.

Despite the stark figures, BPIF economist Kyle Jardine noted that the broad range of industry clients had supported demand in some areas, with the packaging sector providing a stabilising effect.

“The capability to adapt quickly has meant printing hasn’t been as adversely affected as some sectors,” he said.

“However, as we know, shocks facilitate change – what we don’t yet know is what the precise nature will be of the demand that returns; what the industry will lose to accelerated digitisation, what it can gain from entirely new products and revenue streams, and how consumers will behave in the months and years ahead.”

The economic impact of Covid-19 has, unsurprisingly, replaced the long-time leading issue of Brexit as the dominant worry for print bosses.

The top three business concerns are now: Covid-19, the survival of major customers; and late payment by customers.

One respondent to the survey quipped: “Bring back Brexit!”

The report also includes details of paper and board consumption (via the Confederation of Paper Industries) and ink (via the British Coatings Federation).

Annual paper and board tonnage was down 6.2% in 2019 at just under 4.7m tonnes, with the biggest declines in newsprint, uncoated mechanical, and woodfree grades.

The report said that heading into Q2, prices have stabilised for most grades, and have even increased for some packaging grades. But with graphic paper consumption “currently severely weak” due to the pandemic, paper industry consultants EMGE expected paper prices to start falling again as the year progresses.

In Q1 the overall UK sales volume of printing inks was down 8% year-on-year. “Almost all ink categories reported lower sales in Q1 2020 but the publication sector was again the worst hit.”

BPIF chief executive Charles Jarrold commented: “An entirely new set of top business priorities has surfaced this quarter, such is the extent of change we are all attempting to comprehend and channel: the economic impact of Covid-19; survival of major customers; and late payment.

“Companies are exploring how to bring their capacity capabilities back and what demand levels they can anticipate.”

Jarrold said the federation’s efforts were currently focused on representing the needs of the industry to the government and lobbying on its behalf “so as to ensure that government does all it can to deliver the required emergency support and aid the transition through this crisis”.

The BPIF is continuing its weekly lunchtime webinar series throughout June and July with the next session taking place on Thursday (11 June). It will feature a member panel discussion with participants sharing their first-hand experiences of government Covid-19 support schemes, and how they have adapted to the new business landscape.

A number of printing companies have adapted their product ranges to offer ‘back to work’ products such as posters, floor graphics, sneeze screens, dividers and face coverings, helping retailers and other businesses to implement new Covid-secure ways of operation.