The latest filings from administrators at PricewaterhouseCoopers show that PUPL Realisation (formerly Polestar UK Print) has an estimated total deficiency of £409m, while PBL Realisation (formerly Polestar Bicester) has an estimated deficiency of £32.5m.

This includes inter-company amounts owed, for example PUPL Realisation owes £107m to PPHL Realisation (formerly Polestar Print Holdings). Polestar owner Proventus Capital Partners, which loaned the company £90m a year ago and injected a further £11m before Christmas, is also listed among the trade creditors as being owed nearly £350k.

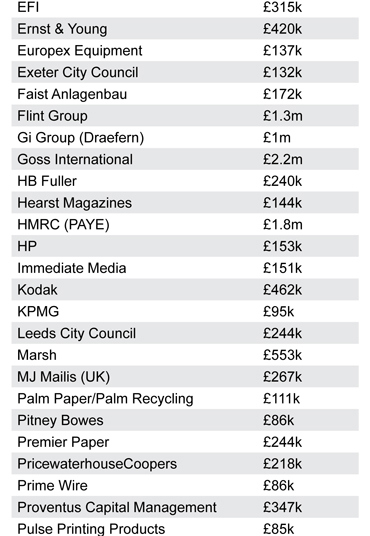

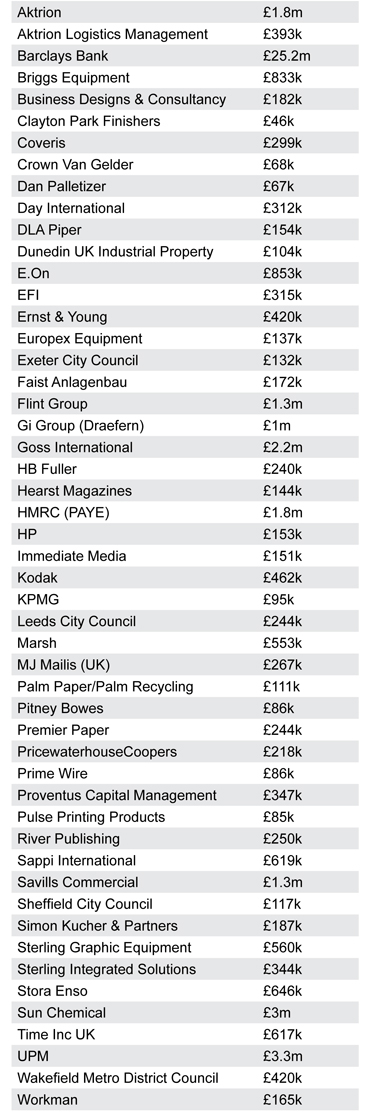

Polestar’s complex group structure, and the fact that the Bicester business remained a separate limited company after Polestar acquired it in 2012, means that some suppliers have exposure to multiple parts of the operation.

The biggest trade creditors of the group include paper manufacturer UPM, owed almost £5m across the businesses, and ink giant Sun Chemical, which is owed £4m according to the report.

Agency staffing specialist Aktrion, which also handled Polestar’s transport requirements through its logistics wing, has also been badly hit and is owed in excess of £3m across Polestar’s operations.

Wakefield’s Sterling Graphic Equipment and sister company Sterling Integrated Solutions are owed almost £1m. Sterling Graphic Equipment was Polestar’s exclusive supplier for the relocation and disposal of equipment in the group, while Sterling Integrated Solutions handled stores and procurement.

Separately, Close Asset Finance is owed £6.3m by what was Polestar Bicester, secured on fixed assets worth £7.7m. Shanghai Electric, the former owner of Goss International, is owed £16m by PUPL Realisation for the new web presses at Sheffield, secured over assets worth nearly £23m.

A number of Polestar’s publishing clients, including Time Inc UK, Immediate Media, Northern & Shell and Hearst Magazines are also owed six-figure sums, understood to relate to paper over-usage.

HMRC is owed £2.26m in PAYE.

The amounts involved in the reports could also increase, or decrease due to a number of factors, such as retention of title.

The PwC report said: “The figures for unsecured creditors do not take account of any amounts paid to trade creditors by the purchaser. Therefore, it is likely that some creditors listed may not continue to be creditors of the company.”

PwC also said that any dividend to unsecured creditors “will only be by virtue of a prescribed part fund”.

“This is due to the considerable amounts owed to the secured creditors of the Company and the expectation that the secured creditors will suffer a significant shortfall on their lending,” the administrators said.

The prescribed part fund is £600,000 in the case of PUPL Realisation, providing creditors with an estimated return of less than 0.3% of their debt.

The estimated recovery for unsecured creditors of Polestar Bicester, owed £43.6m, is 1%-2%, again from a prescribed part fund of £600k.

Secured creditors of the group were owed £131m and have got half of their money back. PwC said secured creditors had already been paid from the sale consideration after Proventus bought it back in a pre-pack sale.

The 'new' Polestar UK Print and Polestar Stones-Wheatons went into administration earlier this week and are now up for sale.

Today (27 April) Unite vowed to do "everything in its power to save jobs and support members at Polestar".

National officer Ian Tonks said: "We firmly believe that Polestar has a future and can be successful. Its workforce is second to none and produces some of the best quality print in the UK."

Tonks said the union would work closely with PwC "to ensure the business is sold to a viable buyer".

SELECTED POLESTAR CREDITORS

PUPL Realisation (formerly Polestar UK Print)

PBL Realisation (formerly Polestar Bicester)