The firm, which floated its former subsidiary on the stock market in 1999 but kept almost one-third of the shares, will use the money to cut debts and improve scope for enlarging its business.

Investment bank Goldman Sachs bought the stake, amounting to 42m shares, and aims to sell it on to financial investors.

Werner Wenning, Bayers management board chairman, said the deal was in line with his goal of enhancing the groups structure made up of 350 companies in crop science and pharmaceuticals.

Bayer shelved the sale of its remaining stake last March because of declining stock markets across the world and a drop in Agfas performance.

Have your say in the Printweek Poll

Related stories

Latest comments

"Gosh! That’s a huge debt - especially HMRC! It’s a shock that HMRC allowed such an amount to be accumulated."

"Whatever happened to the good old fashioned cash job! At least the banks didn't take 2-3% of each sale. After 30 odd transactions that £100 quid you had has gone."

"It's amazing what can be found on the "web" nowadays!"

Up next...

Business is 'on solid ground'

PCP chairman takes majority stake

Ease of use highlighted

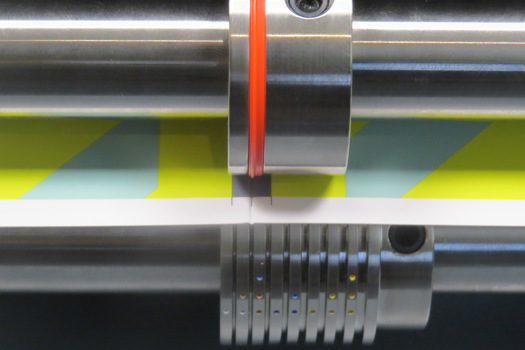

Tech-ni-Fold targets folder performance with new scoring device

Launch due next year

Norske Skog Skogn mill to enter book paper market

Winners announced