But many packaging companies, if anything, reported increasing demand during the pandemic, particularly those dealing in essential supplies like food, drink, and medication, or benefiting from the increase in online shopping that resulted from the various lockdowns. The sector was also quick to respond to the sudden need for huge volumes of face masks, hand sanitiser, and various other PPE.

As work fell quickly away from most of print’s other sectors at the start of the pandemic, with whole industries either shuttered or hamstrung by major restrictions, many printers diversified into new areas to tide them over until their usual customers returned.

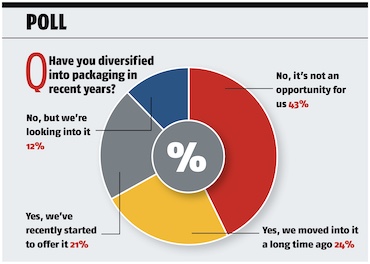

Packaging, unsurprisingly, proved highly attractive. 21% of respondents to a recent Printweek poll said they had recently started to offer packaging services while 12% said they were looking at doing so.

But while there are undoubtedly opportunities for commercial printers in packaging, particularly in prototyping or for short-run work, it is perhaps not as straightforward a sector to sidestep into as it might seem.

The combined effects of factors including the pandemic and Brexit, which have resulted in various logistical and labour issues, has seen the packaging industry – among numerous others – face weeks of intense pressure on energy and materials costs.

Substrate supply has also proven a particularly acute issue, with the effects of strike action at UPM’s Finnish mills that started on 1 January now having severe ramifications, particularly on the steady supply of packaging and labels.

The BPIF joined forces with Intergraf and Finat to urge the end of the strike action earlier this month and, as Printweek was going to press, the situation had started to reach the national news. Outlets including the Financial Times and the BBC had picked up on the potential ramifications of the supply squeeze, the latter speaking to BPIF CEO Charles Jarrold on Radio 5 Live’s Wake Up to Money show.

Will Parker, the former chief executive of Optimum Group’s Telrol self-adhesive label business, has been posting about the issue on LinkedIn over the last few weeks. In a mid-February post on the UPM situation he said the “desperate impact” of the industrial action was becoming clearer.

“With reports of machines standing still now in Europe due to delays or lack of supply this will impact on all consumer supply chains and not those of just food and pharma,” he posted.

“One thing for certain now is that the shelves will be short or empty of key items in the very near future and the continuing lack of any traction or resolution from Finland is a catastrophe we will all feel.

“Even if a resolution is found the ability to restart the supply chain and return to normal levels runs long past quarter two and into quarter three this year and there is no doubt that will drive some companies out of business as they simply are unable to supply.”

UPM itself had cited ‘force majeure’ for its inability to fulfil customer orders.

In December, Reflex Group acquired Macfarlane’s labels business. Speaking to Printweek in early January, Reflex Group CEO Ian Kendall had flagged up what was an already delicate, and worsening, situation.

“Getting materials at the moment is a nightmare, things that were a two-day lead time are a four-week lead time, and things that were a four-week lead time are a four-month lead time,” he said.

“It’s really hard and pretty much all our costs are up year- on-year, probably by about 30%. It’s huge.”

But an even bigger issue than price increases for many companies is getting hold of materials in the first place. While numerous brands and retailers have been moving away from certain materials over the last few years anyway, often to change to more sustainable substrates – the last few months have seen more forced pack format changes due to the shortages.

“I don’t think people are aware of how acute some of the shortages are, and how it’s only the flexibility and competitiveness of the supply chain that’s keeping things on the shelves,” Kendall said.

Early in the pandemic, during a period of carboard box shortages, some supermarkets had to temporarily switch to using plastic boxes for their eggs, which drew criticism from many environmentally conscious shoppers.

BPIF Cartons general manager Jon Clark says that in times of supply shortages, specified materials often “go out the window”.

“In normal times a company will say ‘you must use brand X from mill Y’, but if you turn round and say to them that you can’t do that but offer them brand X from mill A, and the choice is theirs if they have something on the shelf or they don’t – the decision is very quickly made that whatever you’ve got becomes an acceptable material, within reasonable limits.”

He notes, though, that it is usually assumed that brands will change back to their preferred materials once they become available again.

“The materials were originally specified for a reason and when choice comes back, we would expect them to go back. There would probably be an element of shakeout depending on what happens on the commercials.”

‘Shrinkflation’, where pack sizes shrink while prices stay the same, has also been a hot topic in the last few weeks, partly due to the campaigning of food writer Jack Monroe, who called the trend “insidious as hell because it’s harder to immediately spot”.

Quick reactions

Whatever the reasons are for their customers’ pack format changes, packaging companies have to be extremely reactive to push these through swiftly, while not compromising the R&D, testing, and checking stages required.

Clark says he understands why commercial printers are looking at the sector but warns of the various barriers to entry for novices.

“A lot of people are going to realise the hoops that packaging converters have to go through with all the accreditations [i.e., FSC, and PEFC chain of custody]. There are several barriers to entry; one is knowing the standards that have to be adhered to in terms of legislation but also about printing inks, low migration, direct food contact.”

Circling back to the materials supply issue, Clark adds that mills have also put converters onto allocation.

“The message we’re getting is that board is coming through the supply chain but lead times are extended and any new entrant into the marketplace wouldn’t have an allocation, either with the mills or with the merchants.”

Another new hoop for those looking to move into packaging to consider is the Plastic Packaging Tax, which will be introduced by the government on 1 April 2022. All plastic packaging, including tertiary packaging like stretch wrap, will require a minimum of 30% recycled content, or will otherwise be subject to taxation of £200 per tonne.

Much of the sector’s recent M&A activity has seen major players snapping up small, sustainable businesses to enhance their own sustainable packaging offerings.

One such deal was HP Inc’s acquisition of Scottish business Choose Packaging, which claims it is the inventor of the only commercially available zero-plastic paper bottle in the world.

Coveris, which has also been on the acquisition trail lately, has sustainability high on its agenda and Will Mercer, R&D director for the company’s Paper business unit, believes that sustainable packaging is one of the sector’s biggest growth opportunities.

“Sustainability is a key driver of packaging development and at Coveris, we continue to innovate our packaging for improved recyclability, sustainable sourcing and environmental benefit aligned with our vision for ‘No Waste’.”

This strategy focuses on no product waste, no packaging waste, and no operational waste, and Coveris’ packaging developments look at performance, efficiencies, and environmental benefit in all three areas.

The business has recently launched several new paper-based products, as well as recyclable, mono-material films that provide an alternative to non-recyclable films, and films with 30% recycled content linked to the Plastic Packaging Tax.

“The demand for sustainable packaging offers opportunities and as a manufacturer of both paper and plastic packaging, we are able to work with our customers to produce the optimal, most eco-efficient solutions for their product, consumer and environmental objectives,” Mercer adds.

High-quality carton manufacturer Offset Print & Packaging has just become the first UK customer to buy the new generation Koenig & Bauer Rapida 145. The press will be delivered in early 2023.

Despite experiencing the same supply chain pressures as everyone else, the company’s managing director of operations Vince Brearey says the business is continuing to grow.

“We were fortunate in that we haven’t lost any turnover as a result of Covid, in fact we had our biggest year ever last year. It’s just been a natural organic growth through existing customers, probably more people buying online and home shopping.”

Brearey can see the attraction of packaging to new entrants but warns that the required investment “is huge”.

“And it’s not just about the investment but also the expertise and skills of your staff. You can train people, but to produce high-quality cartons day in, day out in a cost-effective manner, you need highly skilled staff.”

Andy Wilson, chairman of FIA UK, the UK’s association for the flexographic industry, acknowledges that diversifying into packaging is not easy “and probably an even more difficult proposition at the moment due to the lead times available on new machines”, with some OEMs currently offering 18-24 months, but he says there are opportunities out there.

“The most obvious markets for commercial printers to step into are narrow-web flexibles, labels, and carton packaging markets,” he says.

“What the commercial printer needs to understand though is that this is an entirely different specification and value chain.

“Brands, repro houses, printer converters, packers and retailers all have varying roles to play in the supply chain – which is becoming more automated, integrated and connected all the time – and the seasonality and development phases for new pack launches can be six to nine months. It is not always an individual job-driven market like much of the commercial print sector.

“Our advice would be to talk to organisations like ourselves at FIA UK to understand the market needs, technologies, trends, and challenges.”

Despite the numerous obstacles and additional current market pressures, there are nevertheless opportunities in packaging out there for commercial printers, especially for those that have a sustainable offering in mind.

Wilson concludes: “Packaging is a fascinating market to be in and there are a number of opportunities on the horizon for all parts of the value chain.

“Whether digitisation, automation and connection streamlining the supply chain from the brand, through to the converter, retailer and to the consumer, or sustainability and the circular economy changing packaging formats and consumer understanding of the role of packaging in their lives. The industry is incredibly dynamic and innovation-led making it an exciting industry to work in today.”

OPINION

A fantastic opportunity for driving innovation

Jo Stephenson, managing director, PHD Marketing

Jo Stephenson, managing director, PHD Marketing

It’s clear that the pandemic has had devastating effects on many businesses in the commercial print sector, and yet the label and packaging sectors – in the main – have benefited from the recent upswing in onshoring and e-commerce. For commercial printers looking to diversify into packaging, then, the most obvious adjacent markets, where skills and technologies may be transferable, are flexible paper and carton packaging for the food, health, and personal care markets. Beneficially, fibre-based packaging demand has been growing exponentially because of the pressure on brands to shift to plastic-free solutions.

The challenge comes in building knowledge to tap into what is an entirely different specification chain; learning to deal with new brands and retailers, with different expectations on print standards, lead times and accreditations for health and food safety. These markets are predominantly served by offset and flexo printers in the UK, along with their repro partners, who have tremendous skills in design, conversion and developing new sustainable solutions, despite much of the media rhetoric to the contrary.

The packaging industry has also not escaped the ravages of Covid-19 and Brexit unscathed. Materials, parts and machine prices are escalating rapidly along with lead times, creating significant barriers to entry for new companies seeking to enter the market. 12-18 month lead times on machines are not uncommon and parts and materials lead times have doubled, if not trebled, in many cases.

All of this presents a conundrum for new entrants – the packaging market typically grows in line with GDP and there is tremendous opportunity for innovation providing entry points for new providers. However, tapping into a brand to get approved supplier status can be arduous in terms of technical and commercial knowledge needs, and then securing scalable assets to be able to begin supply is going to be tricky. There’s definitely opportunity but some clever planning and investment is going to be needed.

READER REACTION

Are there opportunities in packaging for smaller businesses?

Mike Beese, managing director, DecTek

Mike Beese, managing director, DecTek

“In my experience it’s the biggest opportunity; packaging will wrap itself around smaller businesses. If you can adapt and get into the personalisation of packaging, it’s low quantities but high frequency and high margin so it’s ideal. We have noticed a massive trend and are probably hitting around 15 to 20 enquiries a day at the moment. We know our sweet spot; originally it was up to about 100 units but now we’re running up to about 10,000 units – that is the market that litho can’t deal with.”

Dominic Hartley, commercial director, Lexon Group

Dominic Hartley, commercial director, Lexon Group

“There are more small crafters around these days; during lockdown a lot of people decided to pack in the desk job and start making things – like candles out of coffee grounds – and they’ve all got to package the products. They don’t want to put them in plastic, so carton packaging is definitely on the up. The volumes are low, and I don’t think the big boys want to know about looking after 200 of this and 300 of that. We’re just about to launch our [web-to-pack] website where you can order as little as 100.”

Dan Bakewell, managing director, Fine Print

Dan Bakewell, managing director, Fine Print

“Some years ago, we expanded our graphic display department and that took us into very short-run packaging such as prototyping. That partly led us into an increased volume of short-run packaging on the litho side because customers that we’ve done 50 boxes for then ask for a quote for 1,000, 2,000 or 5,000. I also think smaller brands want to compete with bigger brands in terms of quality and the shelf image; historically they perhaps didn’t have the budget, but costs have come down.”