Corrugated box and display making has been the spearhead for digital in the converting sectors. Relative rates of adoption are way ahead of the larger but more constrained boxmaking sectors. Industry pundits tend to have several different explanations, but it seems to be a combination of different volumes between the sectors, lead times, supply chains, quality expectations and indeed management attitudes and flexibility.

Digital printing can replace litho or flexo for either pre-print or post-print production, although each require very different configurations. Pre-print just prints the top liner paper which is later glued onto the rest of the corrugated roll. It uses a roll-to-roll inkjet with comparatively simple unwind-tension-rewind media transport, albeit very wide. Post-print means adding print onto the corrugated boards. It needs a heavy-duty sheet feed and transport to delivery system to handle the large, thick and heavy but comparatively floppy boards. Laminating is a mix of the two – it prints onto paper sheets that are later glued onto corrugated sheets – very often this is litho print on gloss paper for top quality retail boxes or display units, hence the term ‘litholam’.

One advantage of these very large inkjets is that they can be much larger than even the largest litho press. Boxes for the largest retail goods, such as big televisions, lawn mowers and so on, might need two or more litho sheets to be laminated on to cover the whole area. A big digital press can do it in one.

The first post-print inkjets were UV flatbeds with multi-pass heads and either manual loading or heavy duty automated systems, printing directly onto corrugated boards. They do a very good job, especially as they can give litho quality directly onto sheets that are larger than any litho press. However, the UV ink limits use around food packaging and multi-pass heads mean that flatbed throughput is quite slow – even the very fast Inca Digital’s Onset X HS series can only produce 283 ‘beds’ per hour on 3.2x1.6m sheets. The past decade has seen the development of high-speed single-pass inkjet presses with robust sheet feeders for much higher throughputs than flatbeds can ever manage – these can handle thousands of sheets per hour.

Hinojosa achieved world-first Fogra PSD certification on its EFI Nozomi earlier this year

Nick Kirby, chief executive of Swanline Group, spoke at the Smithers Digital Print for Packaging conference in December 2019, one of the last face-to-face events before the pandemic lockdowns. Swanline Group comprises Swanline Print, a trade printer supplying solely boxmakers and packaging companies; and Swanline Paper & Board, which makes corrugated materials through its CorrBoard joint venture with McLaren Packaging.

Digital print for corrugated has been met with caution, or trepidation, Kirby said. “It is expensive, but there are new opportunities. There is enhanced constructional design capability when combined with digital. It is a platform to recover lost opportunities, meaning jobs that would have been turned away in the past.” However, he added in warning, “print innovation should not be undersold – we should not allow it to become commoditised”.

Swanline Print uses multi-pass HP Scitex FB10000 inkjets for digital corrugated work. These are productive for their class, but Kirby also gave his opinion on the faster single-pass presses that are appearing. “Single-pass sheetfed quality is comparable to litho. It is competitive for short to medium railings and very versatile. The speeds can be 6,000sqm/hr, so it is 10 times as fast as multi-pass.” However, he added: “These are unproven print platforms. The costs are still high. They have a large footprint, and you also need lots of space to store the board, given that throughput. The costs of ownership are largely unproven.”

Guy Thompson, strategic account manager at HP (digital print systems for Corrugated Packaging), says: “Our corrugating customers are actually doing well during the pandemic, as a lot of the work is food-related and still needed.

“E-commerce is also taking more corrugated boxes. All say that corrugated business is growing and digital with it.”

He points out that to the packaging converting sector, whether folding cartons, corrugated boxes or flexible packaging, print is a relatively minor part of the whole process. “They also need to consider making the corrugated board, die-cutting, gluing, assembling, etc. There is lots of automation, autofeeders, conveyors, etc, to a degree that would astonish commercial printers. There’s lots of MIS and other software too. One reason to buy digital is to help deal with bottlenecks.”

Durst's Delta SPC 130 on show at Drupa in 2016

Similar to the initial appeal of digital labels printing for small-company low-volume craft beers and jams, digital corrugated is being used for corrugated presentation packs for these goods, says Thompson. However, some of the very largest brands are also finding the flexibility of digital useful for where they have a lot of different sub-brands using more or less the same packaging but for different markets, or multiple colour schemes for consumer goods such as toasters and kettles. “You can also change a design next week for a particular campaign, with no lower limit on numbers.”

Over the past five years, since the 2016 Drupa, the pattern of developers and joint ventures has shifted quite a bit. Bobst entered the corrugated press market briefly, pulled out and now plans to get back in with a future project by its Mouvent inkjet operation.

Sun Automation made its CorrStream aqueous ink high-speed printers from 2013 but decided to go back to its core business of making corrugated feeders. It transferred the inkjet project to Domino Printing Sciences last year. Domino calls its version X630i, with speeds up to 75m per minute on a print area of 3,000x1,345mm. So far one has been sold, to US-based Independent II in Kentucky.

Spain’s Barberán was early to market with its Jetmaster fast corrugated UV inkjet in 2013, created out of its experience with digital laminates printers. Current models have six colours (CMYK, orange and green) and variable data support. Dennis Van Ijzerloo, export manager, says: “Barberán has supplied 25 lines thus far. In the US where our biggest market is they use the machine specially to convert litho laminates to digital, so a lot of it is display but also industry. Here in Europe, clients like Smurfit Kappa are using it only for industrial work, replacing litho where possible but mainly to convert short runs up to 2,500-3,000 sheets to digital, as running costs are lower and the process faster.”

Sales in the US are roughly twice those in Europe, he says. “In the USA there is a lot of litholam work, of which 70%-80% could go digital. This gives huge savings. In Europe the conversion potential is more flexo to digital, where the cost savings are smaller – so there is less obvious advantage in Europe.”

At Drupa 2016 Koenig & Bauer, which was still called KBA at the time, announced a joint venture with Xerox to develop an ambitious hybrid inkjet folding carton press called VariJet 106. This didn’t get far and in 2019 Koenig and Bauer set up a new joint venture with Durst instead. VariJet 106 will now use Durst’s inkjet tech. The joint venture however has inherited two different corrugated single-pass press projects: Durst’s SPC 130 and Koenig & Bauer’s CorruJet. Officially both will be retained, with SPC 130 being sold to medium-to-high volume users and CorruJet for very high-volume, high-resolution needs.

Robert Stabler heads the new Koenig & Bauer-Durst joint venture. This covers the post-print corrugated sector as well as folding cartons. Post-print is addressed by Koenig & Bauer’s work with HP on the T1190 and isn’t part of the Koenig & Bauer-Durst venture. “For supply chain models from converters to customers, digital is very efficient,” he says. For early adopters you can be targeting your brand customers, to use the technology for promotional print and change it frequently. There’s also no extra cost for track and trace.”

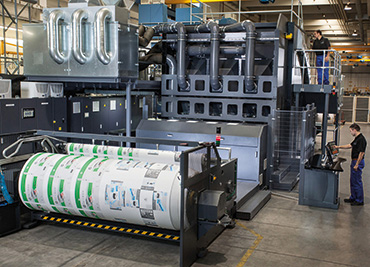

HP’s huge 2.8m-wide web-fed 1100S inkjet

EFI, which entered the corrugated market at Drupa 2016 with its 1.8m-wide six-colour Nozomi C18000, has seen sales take off in an unexpected direction. It was originally configured with commercial boxmaking in mind and sold to customers such as Hinojosa in Spain (which now has four Nozomis, and is believed to have the world’s largest direct-to-board printing capacity), and DS Smith Iberia for that type of work. However in February a revised 1.6m seven-colour version was announced that’s been tweaked for display graphics – deliveries will start later this year. The seventh channel is white, handy for plain brown liners.

Ken Hanulec, vice-president of worldwide corporate marketing at EFI, says: “The company was surprised at the level of interest expressed in this printer by display graphics customers, and we have been able to respond to demand with the most productive solution dedicated to that market. Single-pass technology, done right, has the potential to change every print vertical it touches and give our customers unprecedented new opportunities.”

UK users Delta Group and Durham Box were already using the original 1.8m Nozomis for display as well as boxes, while McGowans in Dublin also put in a Nozomi specifically for display work.

Durham Box has been running its Nozomi since the beginning of 2020. “We wanted a machine that could produce POS as well as e-commerce packaging with the quality to allow our clients to really make an impact, combined with speed of turnaround and being able to print white,” says Andy Smith, the POS business development director. He adds that it “has opened up market sectors, creating new clients for us, and has enabled Durham Box to be recognised as a national provider of 3D POS. It has also helped us provide additional services to our existing client base, offering innovative solutions combined with the ability to react very quickly to clients’ demands.”

He says work done so far on the Nozomi includes “some high-quality e-commerce packaging aligned with POS FSDU (free standing display units), giving our clients consistency of brand. Large POS run capability has allowed Durham Box to react quickly to client demands in this very reactive world, as well as being able to focus on regional campaigns for businesses that want a bespoke solution”.

EFI claims a market-leading position in high-speed single-pass for corrugated with more than 30 installations worldwide, and print volumes increasing at its customers during 2020 despite the pandemic.

HP was already selling the T400S inkjet web press for the corrugated pre-print market at Drupa 2016, but was also talking about a forthcoming single-pass post-print board press, the C500, as a faster water-based alternative to its big FB10000/11000/15000 UV flatbeds, which had adaptations to feed corrugated. It uses food-safe aqueous inks on sheets up to 1.32x2.5m, running at 75m/min.

The first C500 was installed at LIC Packaging in Italy in July 2018. Sharon Chesler, marketing manager of HP PageWide Industrial Corrugated in Israel, says: “We currently have nine installations of C500, five in North America, and four in Europe. Since the beginning of 2021, two of our current customers announced their purchase of a second C500 to their plants, and an additional customer in North America will be announced very soon.”

The Domino X630i

She says the type of customer varies between pure digital companies, such as CompanyBox (in Charlotte, North Carolina), to plants that focus on high-value digital print and web-to-pack (e-commerce) such as The BoxMaker (in Seattle, Washington). “But the majority are converters who have already traditional processes as offset or flexo, and are transforming their clients’ jobs to digital. Many of them are industrial production companies with high-volume printing, such as LIC Packaging in Italy, Vanguard Packaging in Kansas City, Missouri and Golden West Packaging in California.

“Each of our customers focus on their value proposition to their specific clients. For example: Golden West Packaging specialises in packaging for wine and agriculture since many of its clients come from these industries. Our true water-based inks, which are safe for food packaging, provide them with this advantage.

“Sustainability is one of the drivers of the HP PageWide Corrugated business, with operations tightly focused on a circular economy that spans our entire value chain and beyond.”

HP’s Thompson’s role covers the pre-print market addressed by the big web-fed inkjets, the current 1.06m wide, 183m/min PageWide T440S and the huge 2.8m T1170S (183m/min) and T1190S (300m/min), all with water-based inks. Koenig & Bauer supplies the media transport, although the resulting presses are sold entirely as HP machines. Thompson says that “the T470S is a replacement for litho laminating, while the T11xxS are for use with corrugators”.

So far the only other 2.8m pre-print inkjet is the BHS Corrugators project with Screen to develop the RSR (‘Roll to printed Sheet in Realtime’) inkjet, built in Cambridge in a new unit next to Screen-owned Inca Digital. The first alpha is expected to be installed at a German site very shortly.

The powerful potential in being able to rapidly personalise or version output on these devices was demonstrated by Italy’s Ghelfi Ondulati, which used its HP PageWide T1170 to print liners for the apple growers’ collective Melinda. In 2016 Melinda raised funds for an area hit by a devastating earthquake by printing apple boxes with supportive messages from a social media campaign. A second campaign in 2019 promoted apple sales by putting photographs of individual apple farmers with personal stories onto 1,000 variations of the boxes. When the boxes were stacked in a store each one showed different farmers on the sides.

It’s instructive to compare the digital corrugated case studies with those of folding carton converters. The folding carton sector hasn’t got far beyond limited-number novelties: personalised gifts, keepsake and collectors’ items from established brands. Digital corrugated is a more solidly based market where adopters are using their imaginations and offering proper production runs of applications that take full advantage of the digital technology, such as access to quality products for smaller customers, more SKU options for larger brands, and regional or seasonal variations.