Pesonen said the group had managed to successfully navigate an “exceptional” operating environment, delivering an overall performance that exceeded its financial targets.

“Our earnings returned to strong pre-pandemic levels, and five out of our six business areas surpassed their long-term financial targets. The world economy recovered quickly from the previous year’s deep slowdown.

“Demand for our products was strong in all business areas. We improved our margins, despite significant raw material and energy cost increases,” he stated.

Regarding the large-scale strike action at its Finnish operations, which has already resulted in some customers having their expected deliveries stuck in Finland, UPM said it aimed to start negotiations with the unions as soon as possible “and to look for solutions together”.

“Our focus is not on next month or next year, but rather on pursuing mutually beneficial outcomes that will enable each business and their employees to prosper well into the future, into the 2030s.”

However, yesterday paperworkers union Paperiliitto said there had been “no progress” in a meeting between the two parties held this week.

“Unfortunately, no new time was agreed. The preconditions set by UPM for the negotiations are so strict that there were no preconditions for continuing the discussion, said union chairman Petri Vanhala.

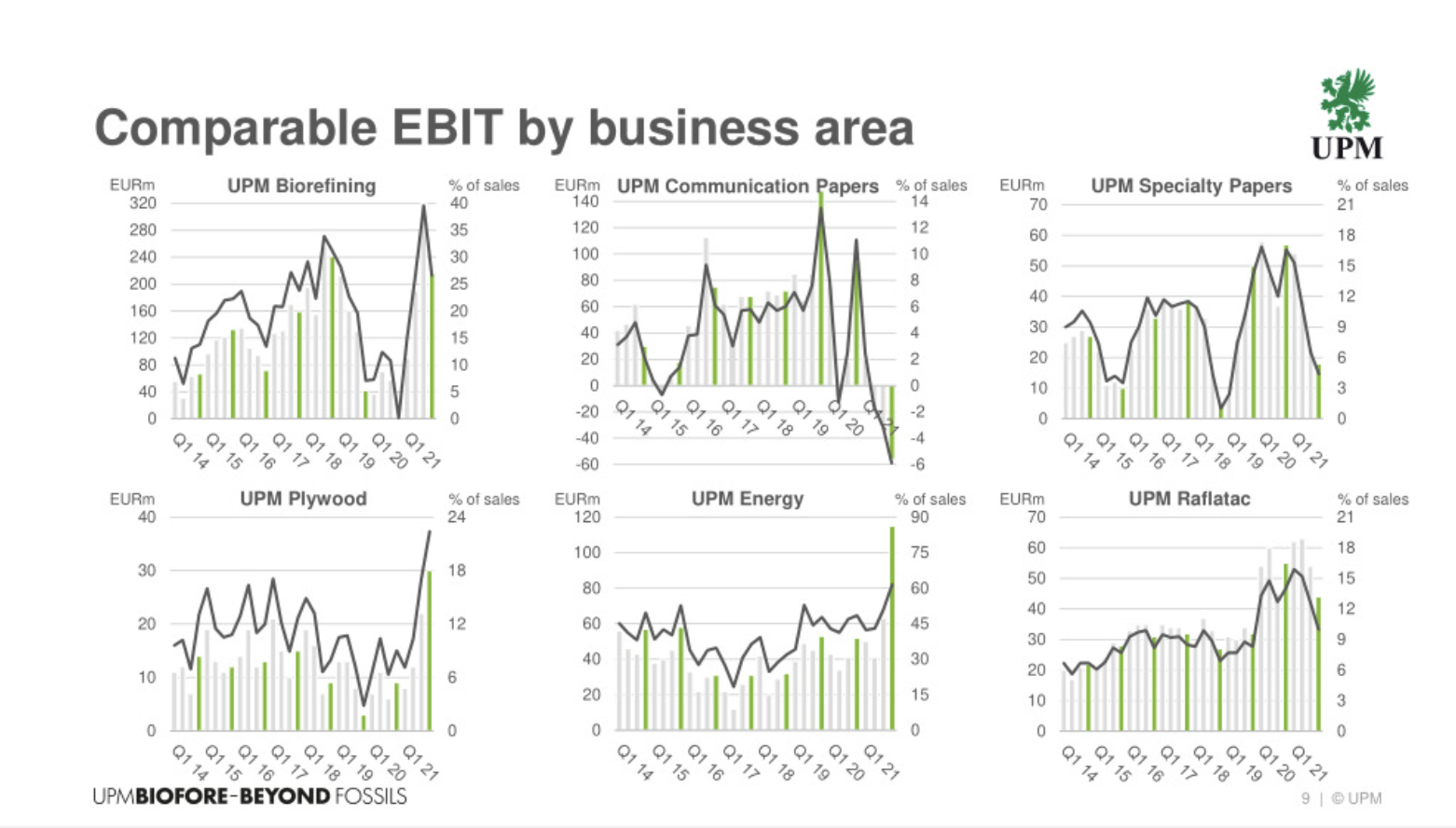

In its results for 2021 UPM’s group sales were up 14% to €9.8bn, while comparable EBITDA jumped by 55% to €1.47bn.

UPM’s Energy business posted its best-ever results in Q4, but this had a knock-on impact on paper.

“UPM Communication Papers continued making losses throughout Q4. The main reason for this was the exceptional increase in energy costs. Owing to existing customer contracts, we were unable to adjust paper prices at the same pace, despite tight paper markets,” the group stated.

UPM’s growth businesses make an EBITDA margin of 17%, while the margin at Communication Papers lags at 5%.  UPM Communication Papers was the only loss-making business unit

UPM Communication Papers was the only loss-making business unit

CFO Tapio Korpeinen commented: “Average paper prices increased by 6% but this was not enough to offset increased energy costs.”

At UPM Specialty Papers demand for label, release and packaging papers “remained strong” but profits were affected by the high cost of fibre and energy.

UPM Raflatac reported 10% margins in Q4 and profitability is “well above pre-pandemic levels”.

However, while demand remained strong at the Raflatac wing and prices increased, “unexpectedly rapid cost inflation and supply chain bottlenecks have necessitated mitigating actions”.

UPM said that prices for many of its products – most notably graphic arts and specialty papers – were expected to go up further in early 2022.

Prices for pulp and energy are expected to continue at “good levels” in the early part of the year.

“Our earnings are fully back on the strong pre-pandemic levels. And we expect 2022 to be another good year for the company,” Pesonen stated.