The BPIF's quarterly Printing Outlook survey, released today, sees Brexit as having a major role to play in the negative forecasted balance prediction.

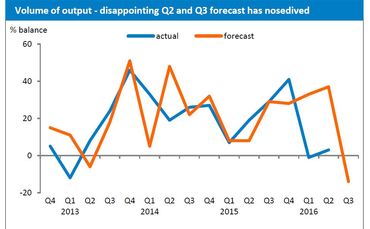

35% of those surveyed believe output will decline in Q3, compared to just 21% who believe it will increase, leading to a forecasted balance of -14, which would be the lowest output balance since Q2 2009 (-35).

Output balance for Q2 was +3, vastly lower than the predicted balance of +37, predicted when hopes were higher during Q1. 34% of printers experienced an increase in output in Q2 with 31% experiencing a decline and 35% maintaining the same level.

Survey data was collected from 99 companies, mostly from managing directors, over a two-week period at the beginning of July.

BPIF research manager and Northern Ireland manager Kyle Jardine said: “When I was writing the report, I was seeing some other economic data saying Brexit maybe hadn’t had so much of an effect. With a bit more depth and looking at some of the responses, people were saying May was okay, then it was quieter in June and July, and other economic data since then has supported that.

“Since Brexit, companies are saying orders are being slow coming through and clients are waiting longer than they normally would to place. Some EU clients are maybe getting the jitters a bit as well, holding off on orders until the outcome is more known."

Alongside Brexit, Jardine also highlighted the quiet summer months as a factor, when staff are absent on holiday and clients are less likely to place orders and add to their workload. He also cited rising paper costs as a concern.

The balance between those believing the general state of the trade had improved and those believing it had deteriorated was -10, 40 below the prediction in the last survey of +30 and down 12 points from the Q1 balance of +2. Predicted balance for Q3 has fallen to -26.

The most voiced business concern was once again competitors pricing below cost, selected by 64% of those surveyed as one of their top three concerns. This figure was a 10% drop from the Q1 survey, but Jardine believes this is due to Brexit causing participants to be more likely to highlight other concerns, such as paper or board prices and access to skilled labour.

Jardine also said the negative recorded output and forecast is following the pattern of other industries.

He said: “I think this is fairly reflective of what is going on. The PMI report was downbeat and engineering heavily cited Brexit in a downturn. Traditionally, print is described as quite a bellwether industry because it does reflect these kinds of things.”

Capacity utilisation fell in the quarter, with a majority of those surveyed believing their capacity to be in the 70%-79% range. Recruitment remained positive, though at a lower level than in Q1 and 42% of respondents said they had a conducted a pay review in the quarter, awarding pay increases averaging 2%.

“I’m hoping the forecasts are overly negative and there will be a quicker return to balance than was feared at the time of the survey. As always, there will be winners and losers, for example, exporters might do well once confidence returns to their foreign clients and exchange rates makes them more competitive,” added Jardine.