According to the BPIF's latest Printing Outlook survey, 32% of printers in Q3 experienced an increase in output compared to 30% who saw a fall, leading to a resulting balance of +2. The figure was some way above Q3’s forecasted balance of -14 but +1 below Q2’s figure, and was the lowest Q3 output level for four years.

Predictions for output in Q4 were high at +21 (37% forecast a rise and 16% forecast a fall).

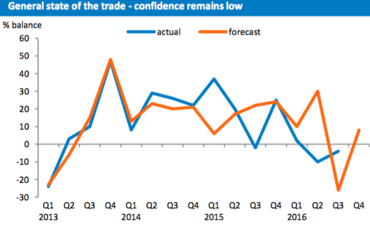

However, in terms of the general state of trade, predictions for Q4 were at their lowest (+8) since the 2007/2008 financial crash. Q4’s 2015 prediction was +24 and 2014’s was +21, both of which were matched.

The balance of respondents believing the general state of trade had improved was -4, up from -10 in Q2 and way ahead of the -26 that was forecast.

BPIF research manager Kyle Jardine said predictions tend to be much higher for Q4 as printers take into account a seasonal upturn.

Jardine said: “On the positive side, things turned out to be much better than the forecast was for this period and the forecast that was made after the Brexit vote. There was a very large amount of uncertainty over how things were going to be affected and that level of uncertainty led to a quiet July period but those forecasts were not realised and things were much better.

“The government's approach to Brexit negotiations is being kept a close eye on but I am reluctant to mention Brexit as some companies aren’t noticing anything, maybe some cost pressure but paper companies are often putting their prices up."

Increasing paper and board prices were listed as the second greatest concern of the quarter, listed by 50% of respondents as a top three concern, a 40% increase on the same response six months ago.

Increasing paper and board prices were listed as the second greatest concern of the quarter, listed by 50% of respondents as a top three concern, a 40% increase on the same response six months ago.

“The depreciation of sterling is putting a bit of pressure here for prices to go up. Some companies have a bit of bargaining power with their suppliers but certainly it is this that would have triggered the concern in response to this question,” added Jardine.

As ever, the most cited concern (64%) was competitors pricing below cost. The third-most cited concern was access to skilled labour (29%), which Jardine said was in some way related to concerns over EU nationals post-Brexit, and was more of an issue in the South than the North.

Profit levels being insufficient and late payments by customers were both cited by more than one fifth (22%) of respondents as concerns.

Capacity utilisation was improved for Q3, with around two-thirds operating in excess of 80% capacity.

Intentions for investment in the year ahead strengthened slightly and, while recruitment levels closely matched the negative Q3 forecast, 30% of respondents reported they had conducted a pay review in Q3, awarding pay increases averaging 0.6%.

Jardine added: “Generally, Q4 is a big upturn quarter and I would hope this can be achieved. The forecasts are relatively low so unless there’s a shock, I would say trade has moved on and I think I would expect us to reach them.”

The survey was carried out over a two-week period from 3 October. It gained responses from 93 print companies, mostly from managing directors and chief executives, employing a total of 3,454 people and generating a combined turnover of £373m.